- Resources

- Corporate Relocation Survey

- EMPLOYEE MOBILITY AND CHANGING WORKPLACES

Corporate Relocation Survey 2025

WORKFORCE MOBILITY

RETURN TO WORK

All types of workplace accommodations trended up in 2024, except for hybrid work arrangements for all employees (52%). Companies reported increases in full on-site return to work (60%), allowing specific areas of the company to stay remote while others returned to the office (44%), allowing employees to choose between remote work or office work (31%), and allowing fully remote work (12%).

There was a surge in the number of organizations bringing employees back to the office from 2023 to 2024. Our survey found that small companies were more likely to report returning to in-person work at 65%, compared to 59% of medium companies and 57% of large companies.

REMOTE WORK

Even in the face of increased return-to-work mandates, the majority of companies reported allowing remote work in some capacity in 2024.

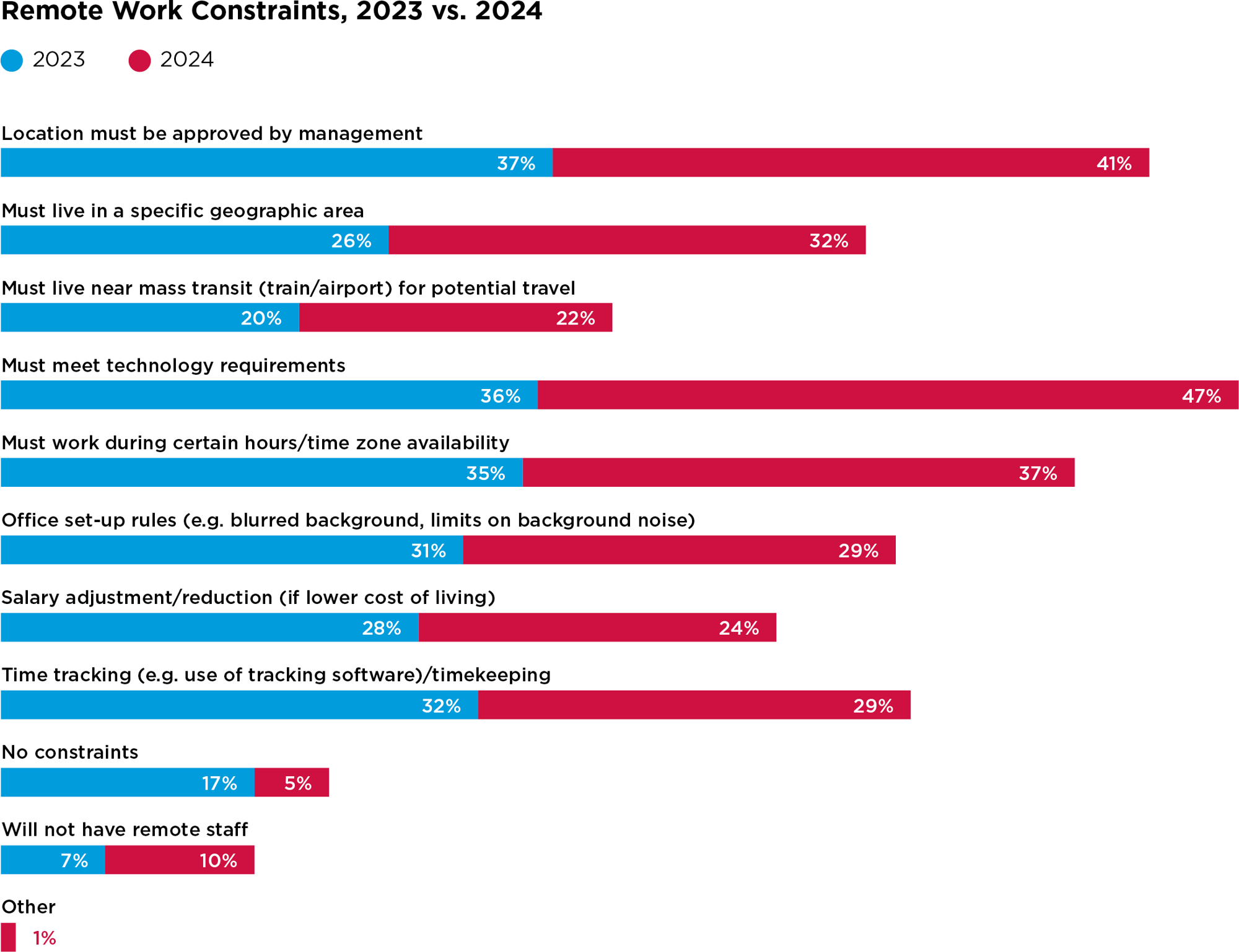

Nearly five years into work-from-home practices, companies have been refining policies to meet organizational needs. The top three remote work constraints were:

- 47% of companies said remote employees must meet technology requirements

- 41% of companies said remote employees’ location must be approved by management

- 37% of companies said remote employees must work certain hours regardless of time zone

OFFICE SPACE

Most companies (51%) maintained the same office space, though fewer expanded compared to 2023. However, 30% of companies considered relocating offices to cities with better workforce availability and business-friendly environments. There are two factors driving this new trend.

- Companies want access to workforce strengths in particular markets.

- Companies are seeking a more business-friendly environment.