Economic Outlook

Post-Pandemic Expectations Are Mostly Positive

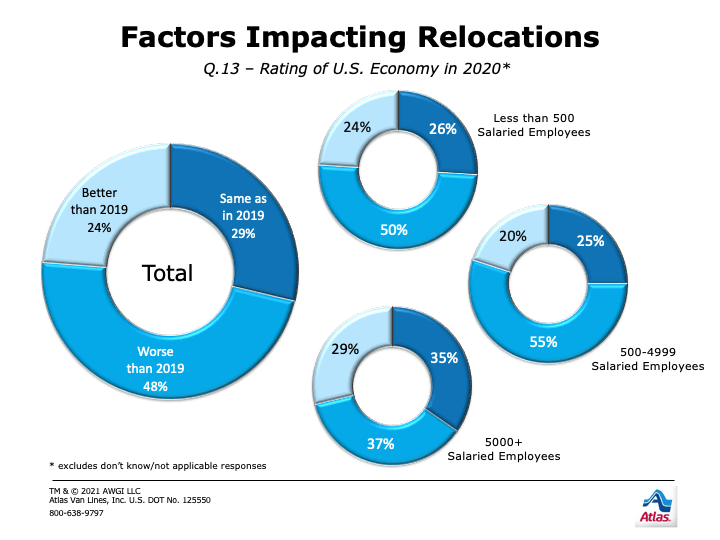

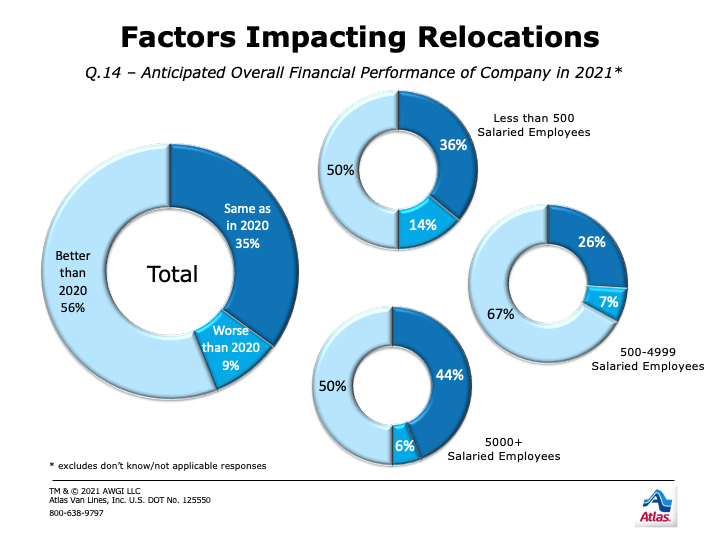

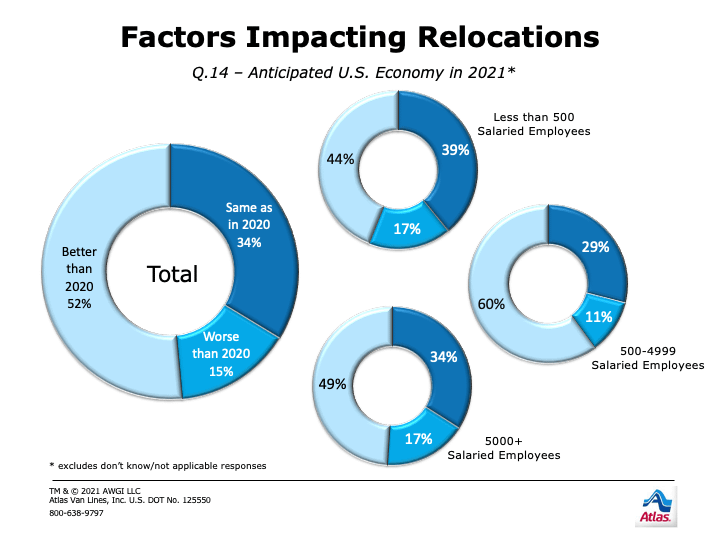

Even though one out of three companies say their financial performance worsened in 2020, and one out of two say the U.S. economy worsened, half or more expect 2021 to be better on both fronts. The vast majority of firms expect either stability or improvement in the U.S. economy in 2021, with a greater percentage expecting further improvement compared to 2020’s experience (52% vs. 24%). Although not as high as some other years, this sentiment runs similar to higher overall recovery levels (51%+). Most firms expect improvement or stability in their company’s overall financial performance this year as well. However, expectations for improvement are muted compared to the past decade (56% vs. 64%+), and almost 1 out of 10 indicate they believe their company’s performance could worsen. Expectations are similar to 2008 (prior to the Great Recession), so caution about how the impact of COVID-19 could still play out for individual companies is evident.

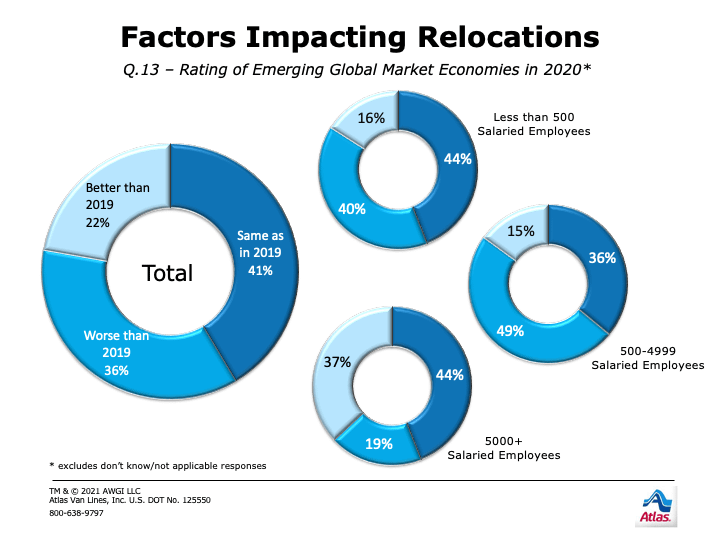

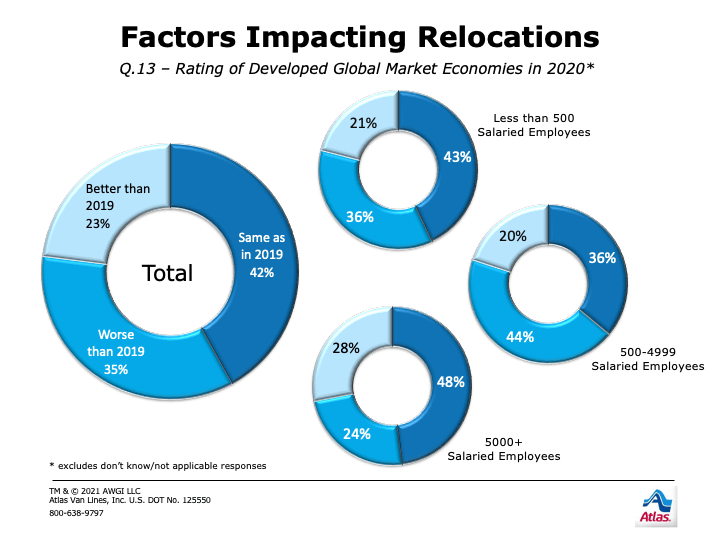

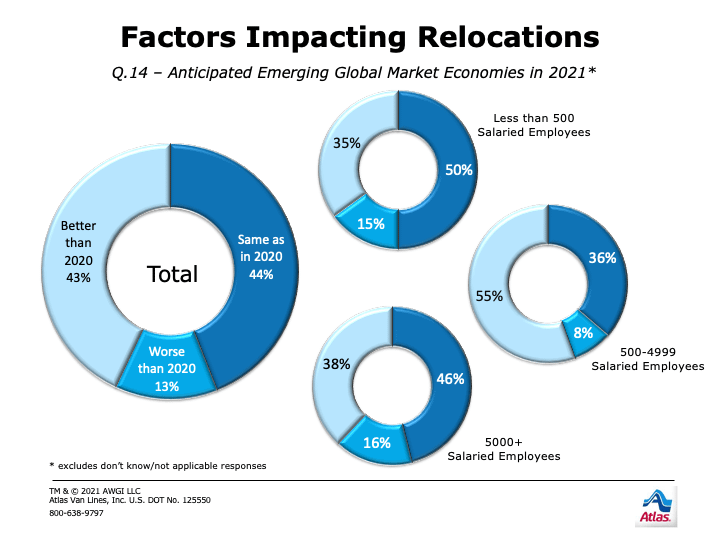

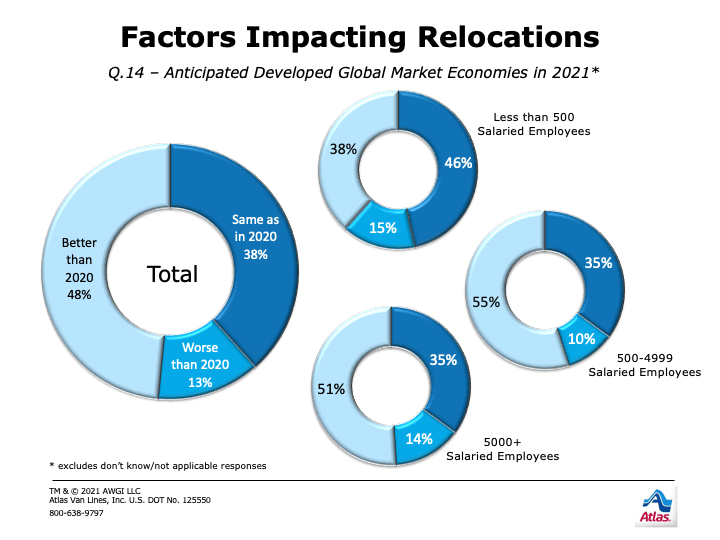

Globally, more than a third of firms indicate the performance of both emerging and developed global market economies worsened in 2020. Expectations for 2021 trend positive, but there is some dissonance. Overall expectations are for growth vs. stability for developed global market economies as the percentage of firms expecting improvement is higher (48% vs. 38%). However, expectations for emerging global markets are nearly balanced (43% vs. 44%, growth vs. stability), and firms in both emerging and developed markets see projections for worsening performances remain roughly double that of three years ago (13% vs. 6%, emerging; 13% vs. 7%, developed). These projections indicate the global picture is optimistic but not one of accelerated recovery from the challenges of 2020.

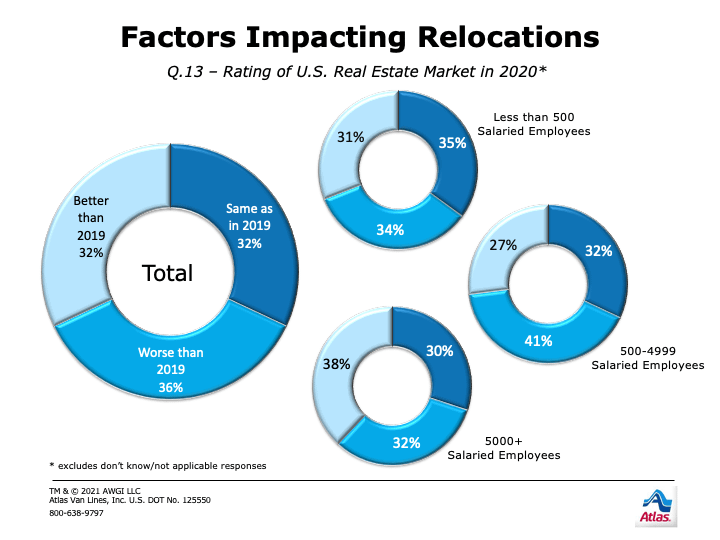

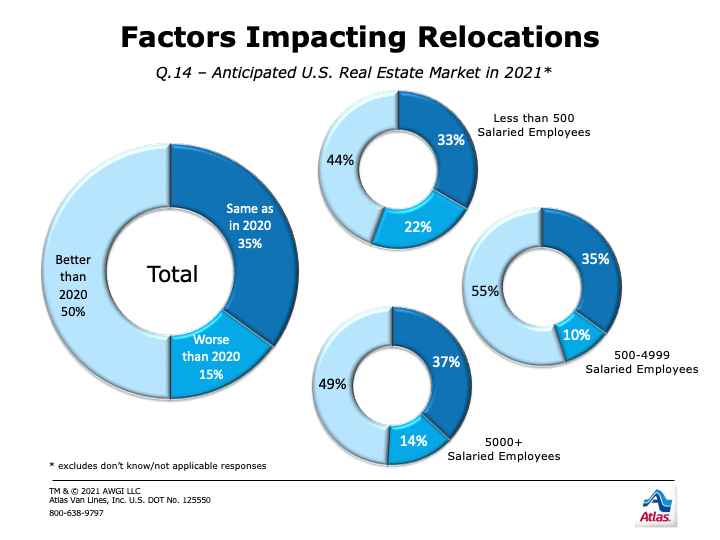

More than a third of firms say the U.S. real estate market worsened in 2020. Expectations for improvement for the U.S. real estate market see notable levels of optimism, higher than the last three years (50% vs. 37%+) and similar to 2017 (55%).

While 15% of firms project the market will worsen in 2021, this is similar to the past 4 years (10%-18%) and may reflect challenges being faced with real estate inventory levels. Prior to the interventions responding to the COVID-19 pandemic, interest rates were rising to stave off inflation as housing costs were notably higher after roughly eight years of recovery from the Great Recession. Interest rates are now hovering near historic lows, home prices and values continue to see increases, and market inventory is tight in many places across the country. Most firms expect further improvement or stability in the U.S. real estate market during 2021, barring unforeseen challenges from the pandemic or other areas.

- Midsize and small firms are the most likely to say the U.S. economy and developed and emerging market economies' performances worsened in 2020. Experiences in the U.S. real estate market and individual company performance were largely similar regardless of firm size.

- Across company size, half or more of firms anticipate better financial performances in 2021, and more than a third expect improvement in both developed and emerging global market economies. Midsize firms are the most optimistic for their individual company performances (67%) and emerging economies (55%), and both midsize (55%) and large firms (51%) are more optimistic than small (38%) for developed economies.

- Roughly half or more of firms across size expect further improvement in the U.S. economy, and around a third expect stability. Midsize firms are the most optimistic about the U.S. economy (60%) overall.

- Expectations for the U.S. real estate market are mostly similar across size, as roughly half expect improvement and around a third expect stability. One-tenth or more of firms across size expect the market to worsen, with small firms the most likely to expect declines (22%).

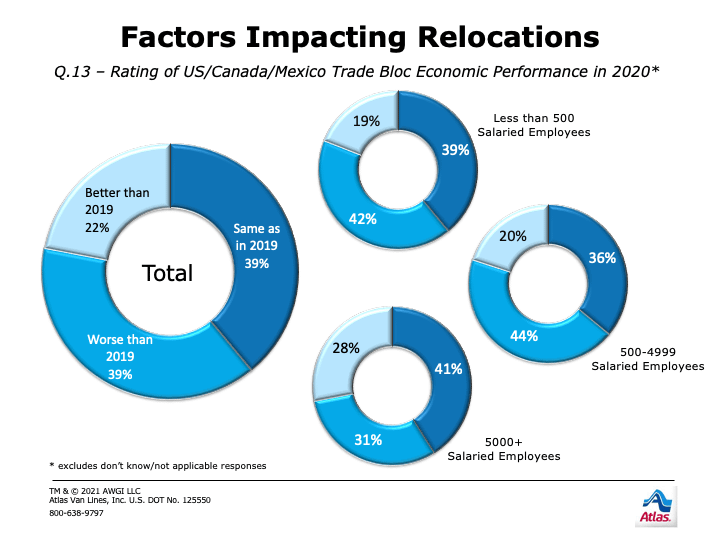

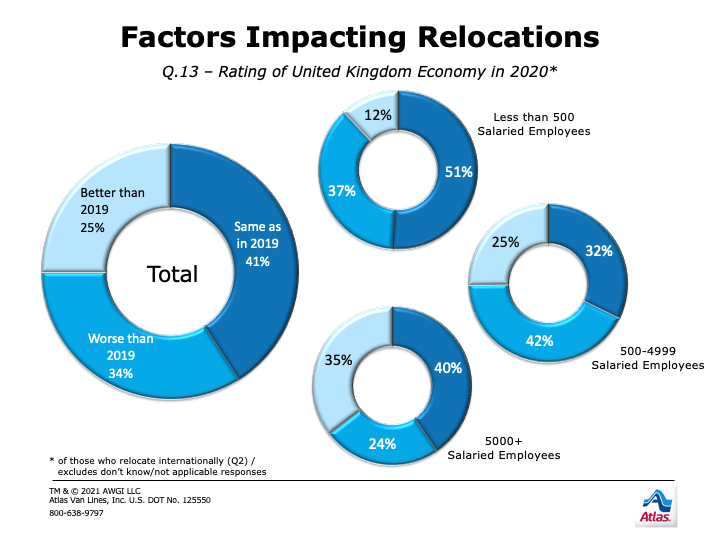

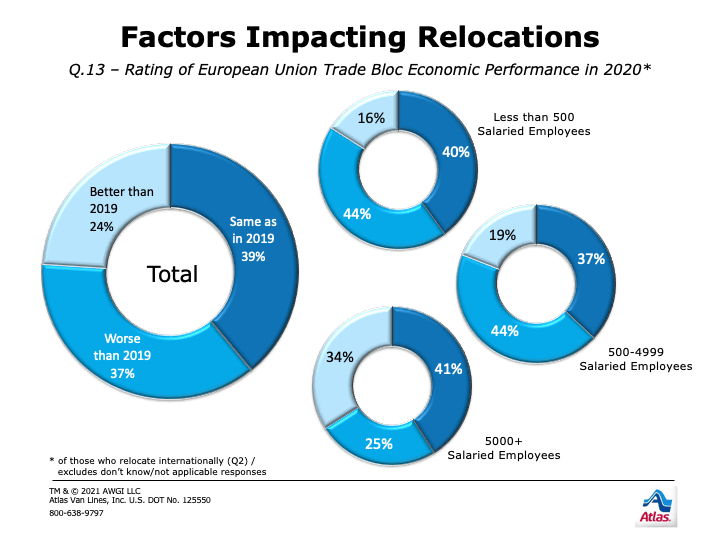

More than a third of companies said economic performances across trade blocs worsened in 2020. Mid-size and small firms say trade bloc performances worsened last year far more often than large firms. When asked about expectations for 2021 economic performance by trade bloc, projections are essentially positive.

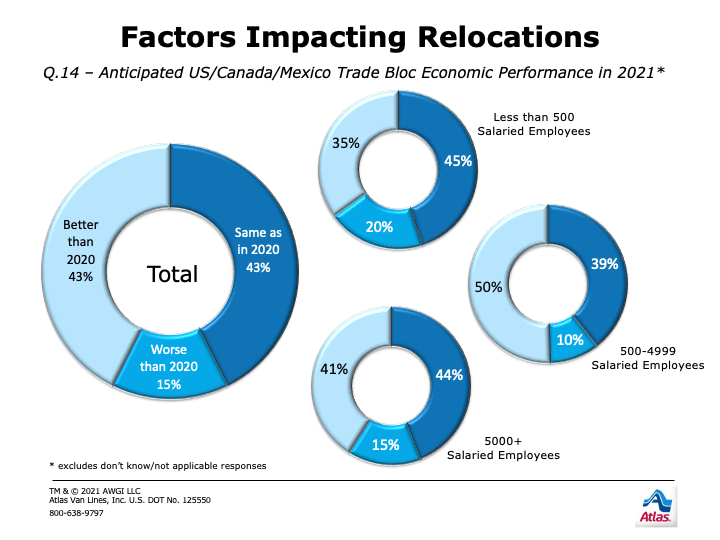

U.S./CANADA/MEXICO

Among all firms responding, 85% predict stability or improvement and 15% predict worsening. Small firms are the least optimistic: one in five expect the North American trade bloc economic performance to worsen, and only 35% expect improvement. More midsize (50%) and large firms (41%) expect improvement comparatively.UNITED KINGDOM

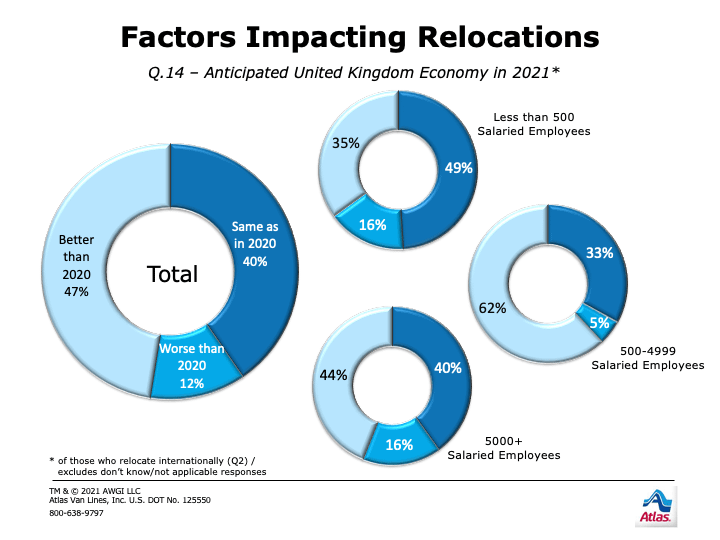

Around 9 out of 10 international firms predict stability or improvement for the United Kingdom’s economy in 2021, while roughly one in eight predict worsening conditions. Midsize firms are the most optimistic, with nearly two out of three expecting improvement. Nearly half of large firms also expect improvement, with only around a third of small firms holding this optimism.

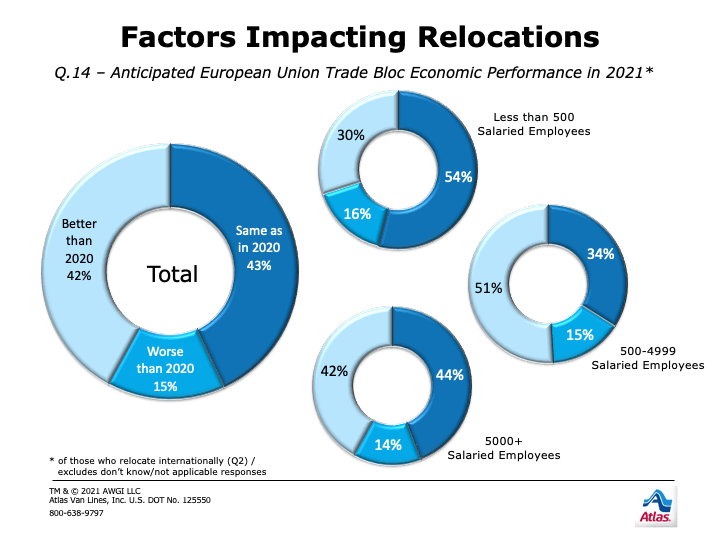

EUROPEAN UNION

Among all firms responding, 85% anticipate stability or improvement in 2021 and 15% expect worsening conditions. Small firms are the least optimistic, with only around one in three expecting the EU trade bloc to see improved performance. Midsize firms are the most positive, with 51% expecting improvement. Expectations among large international firms are essentially evenly split between improvement (42%) and stability (44%).

After the extreme pressures presented by the COVID-19 pandemic, it is encouraging to see optimism as companies look toward the future this year. Perhaps unsurprisingly, smaller companies’ views on the economic impact of the COVID-19 pandemic appear harsher. These firms likely endured greater difficulties than large firms, which have greater diversification of risk. While acknowledging that many experienced hardships, most are looking toward the future with hope.

2020

- 31% say company’s overall financial performance worsened

- 48% say U.S. economy worsened