Invited via email, 414 decision-makers completed an online questionnaire between January 15 and March 13, 2020. Each respondent is responsible for relocation and is employed by a company that has either relocated employees during the past two years or plans to relocate employees this year.

For analysis, firms are categorized by size: |

||||

| SMALL | MID-SIZE | LARGE | ||

| Fewer than 500 salaried employees (34%) |

500-4,999 salaried employees (31%) |

5,000+ salaried employees (35%) |

||

| 58% work in firms that relocate employees internationally. |

||||

In general, 2019 was positive for the relocation industry; roughly nine out of ten organizations

indicate both volumes and budgets either held steady or increased. Prior to the COVID-19 pandemic, projections for 2020 were similarly optimistic. Among firms relocating employees internationally, 44% saw increases in international volumes last year and 44% expected increases in 2020. Only around oneseventh of firms saw decreased volumes last year and expected decreased activity in 2020. While projected increases outpace decreases roughly three-to-one, both the pandemic and Brexit create marked uncertainty. One-fourth of firms moving employees internationally are unsure of Brexit’s impact on 2020 volumes, and the coronavirus outbreak was not on the radar as a significant global threat until a few months into the new year.

ADAPTABILITY & BUDGETS – THE BALANCING ACT

Building in the capacity for relocation to be adaptable to employee needs while keeping costs contained is a nearly universal policy stance across organizations. Through fixed/ flex policy, additional incentives, and cost containment strategies, companies continue to flex the adaptive muscles developed during the Great Recession to keep their talent mobile.

FIXED/FLEX POLICY

Over the past decade, companies have gained a fundamental understanding that relocation policies must have built-in flexibility. Many do this by identifying what relocation costs are considered “core coverage,” or by allowing relocation funds to be used on select services from which an employee can choose. Stipulations by employee level and/or policy are often built in, while many companies simply make these types of flexibility available to all relocating employees.

from 2013-2014. Usage jumps to nearly 100% in 2020, indicating that flexibility in how relocation benefits can be used is essentially universal practice.

INCENTIVES

In addition to having flexibility in policy, the ability to use additional incentives to convince a key employee to take a relocation assignment remains mission critical. Over the past six years, most firms across company size indicate they are offering additional, nonstandard incentives or policy exceptions. Since 2008, the overall use of incentives/exceptions has grown 30% (90% vs. 60%: 2008).

Incentives continue to prove highly successful; essentially nine in ten report they worked

almost always or frequently, consistent with historical levels. Combined with usage at such high levels, this data indicates that being able to flex in this way is also essential for companies to mitigate employee reluctance to relocate and family considerations that place downward pressures on mobility.

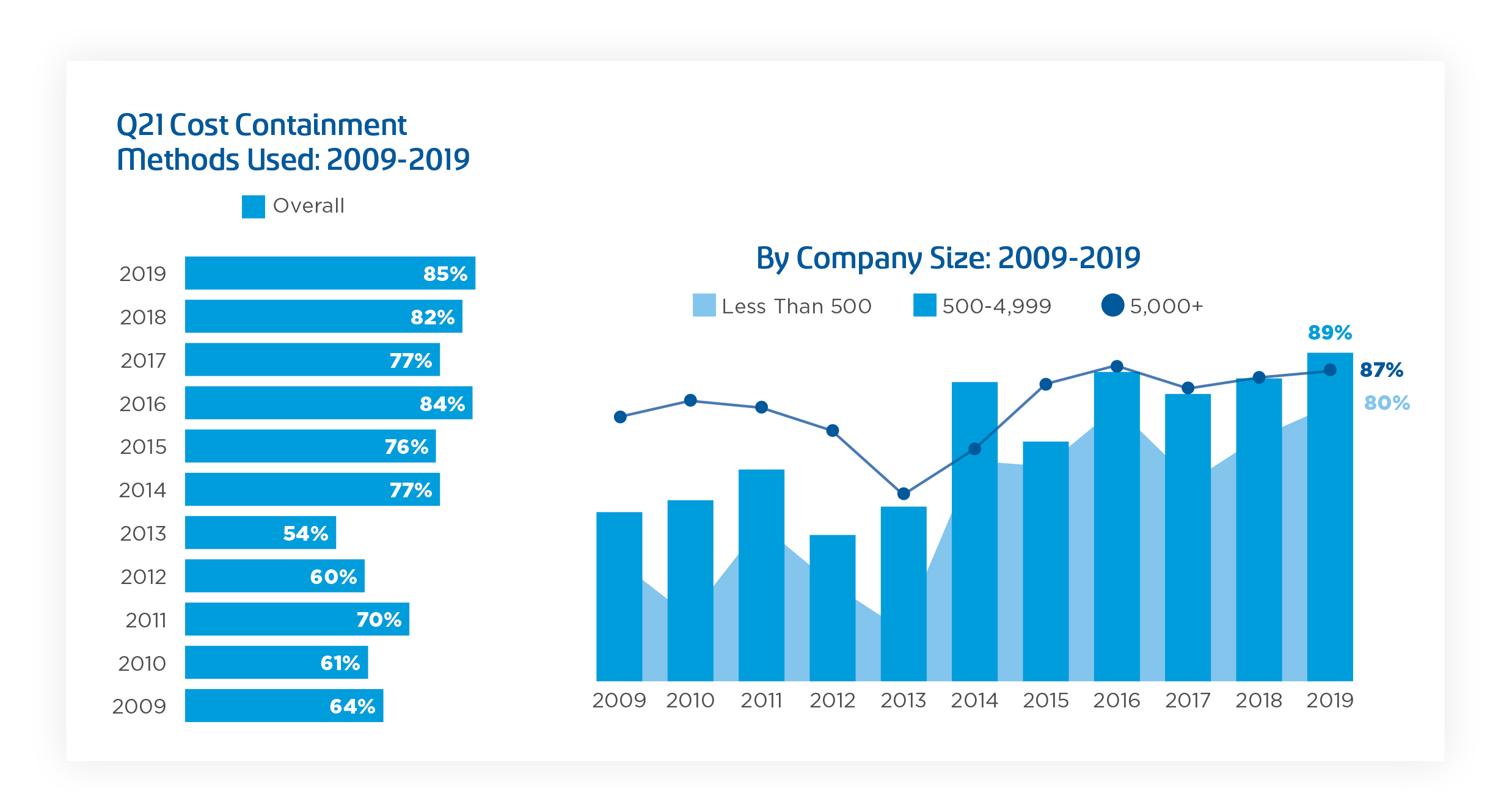

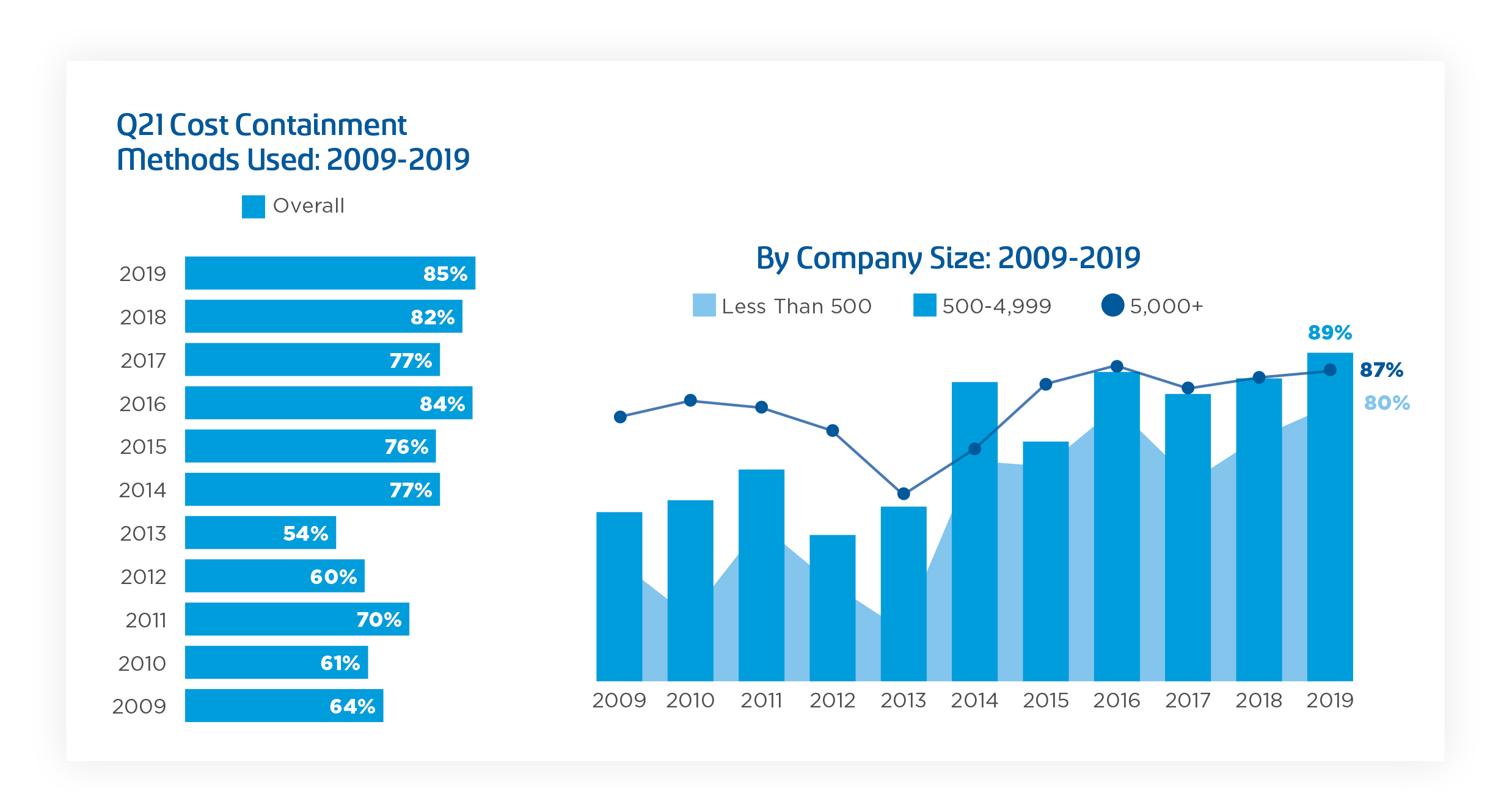

COST CONTAINMENT

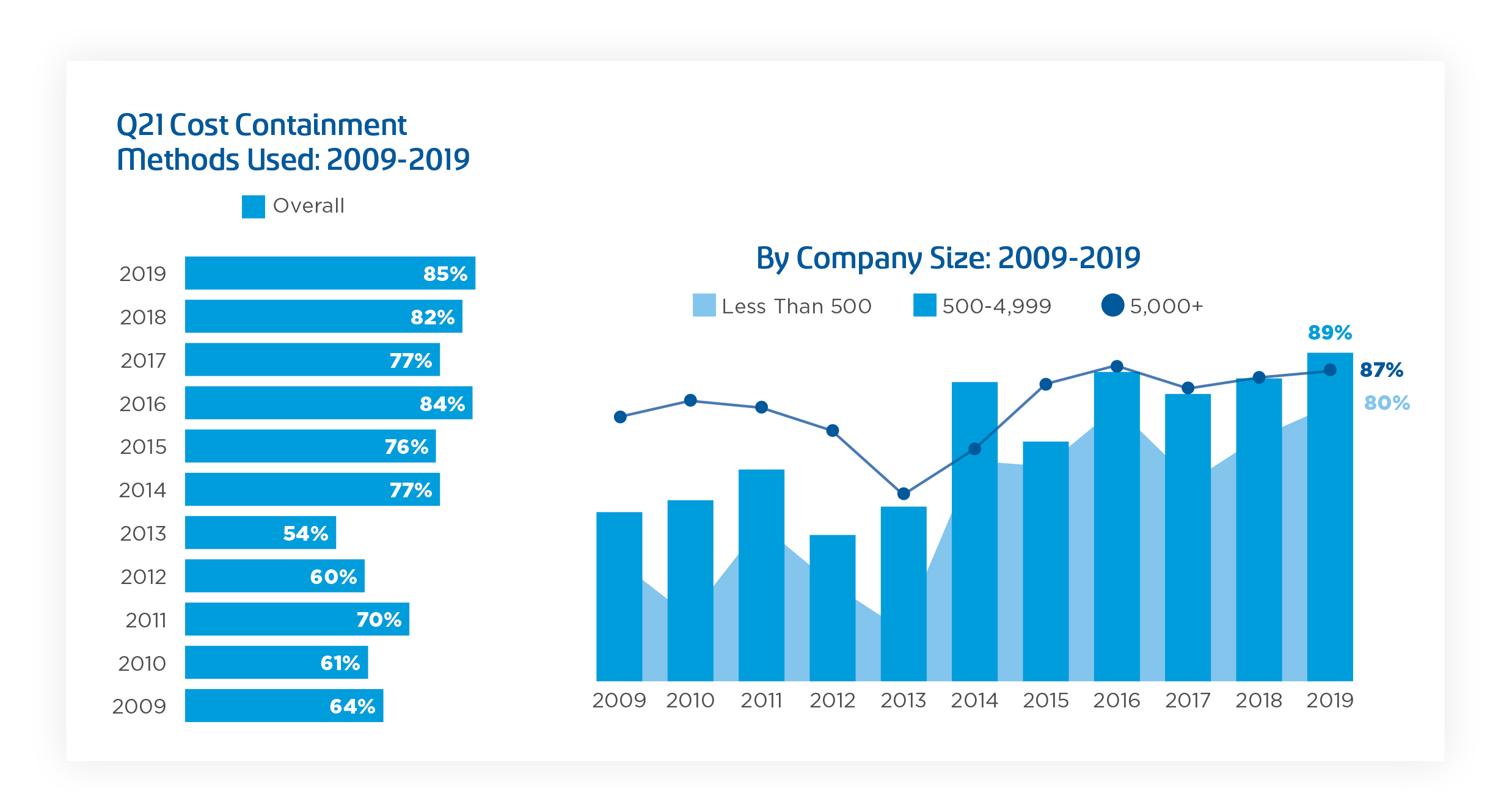

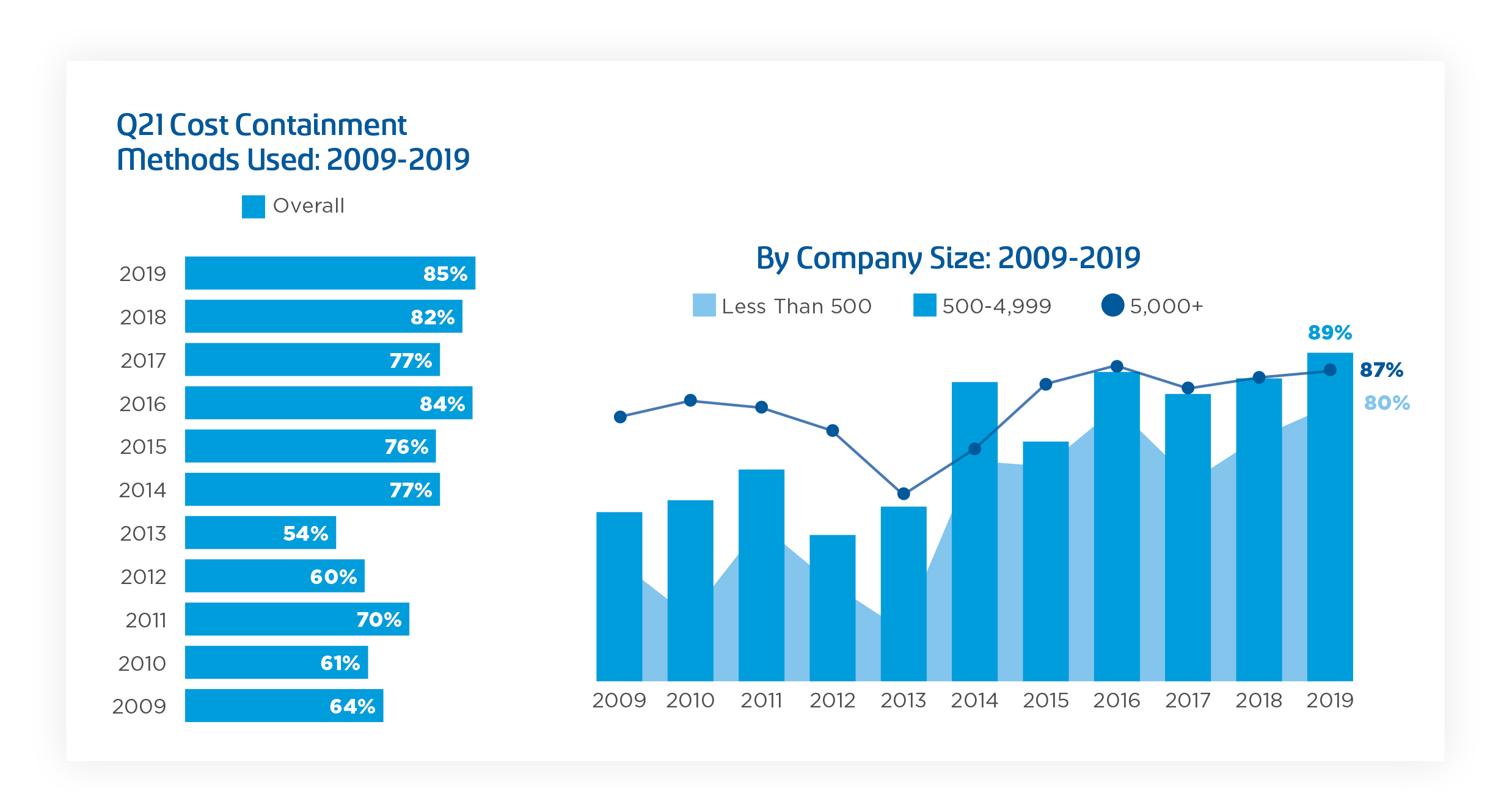

However, even with built-in flexibility and high usage rates of incentives/exceptions, cost

containment measures are also nearly universal. The use of cost containment reaches another historical high, essentially proving the last six years of near constant elevated usage of these tactics to keep relocation budgets within scope is the “new normal.” Prior to 2014, far fewer companies indicated using these types of measures, and those that did were far more likely to be large companies. Company size no longer plays a notable role, as overall usage is now similar across firms of all sizes. So, even while companies flex to move talent, they are also flexing to keep costs down.

The top cost containment method continues to be using lump sum payments for relocations,

with 40% of companies indicating they use them for this purpose. Roughly one out of every four moves in 2019 by firms participating in the survey was estimated to have been entirely paid for by lump sums. Additionally, while most firms use them for domestic relocations, this year saw use for international long-term assignments jump to 40% and usage for short-term, temporary assignments remain above 40% for a second straight year (44% & 42%).

BEND & FLEX

As pressures mount from a variety of places, companies continue to flex the relocation policy and practice muscles developed during the Great Recession and the following recovery. With a global pandemic and the corresponding economic contractions and expansions that will inevitably follow, it’s assured that companies moving talent will continue to find ways to balance both employee needs and company budgets to keep the world moving.