Invited via email, 435 individuals completed the online questionnaire between January 10 and March 6. Each respondent has responsibility for relocation and is employed by an organization that has either relocated employees during the past two years or plans to relocate employees this year.

Who responded?

Invited via email, 435 decision-makers completed an online questionnaire between January 10 and March 6, 2018. Each respondent has responsibility for relocation and is employed by an organization that has either relocated employees during the past two years or plans to relocate employees this year.

For analysis, firms are categorized by size:

SMALL

Fewer than 500 salaried employees (33 percent)

MID-SIZE

500-4,999 salaried employees (34 percent)

LARGE

5,000+ salaried employees (33 percent)

47 percent work in international firms.

Relocation Volume & Budgets

In general, 2017 was another positive year for the relocation industry; roughly nine out of ten organizations indicate both volumes and budgets either held steady or increased. Projections for 2018 are similarly optimistic except for small firms; far fewer saw increased volumes and budgets last year or expect increases for 2018.

Among firms relocating employees internationally, 41 percent overall saw increases in international volumes last year and 38 percent expect to see increases in 2018. Around one-fifth of firms saw decreased volumes last year and expect decreased international activity in 2018. While projected increases outpace decreases roughly two-to-one, the mixed picture reflects a bit of international instability. Given the geopolitical landscape, this is perhaps not unexpected.

Tax Reform’s Impact

A key issue emerged in December 2017: the passing of the U.S. Tax Cuts and Jobs Act. It eliminates the moving expenses deduction for the next eight years. The survey incorporated additional questions to assess the

potential impact of this bill. Five key aspects of relocation were queried: costs, policy, administration

complexity, recruiting difficulty, and volumes both for 2018 and 2019- 2025. While there is some uncertainty, the vast majority of respondents across company size provided estimates on expected impacts.

RELOCATION COSTS:

- Around half of organizations expect the legislation to increase relocation costs both in 2018 and over the next eight years. Far more mid-size and large firms feel this way in regard to 2018 (53 and 68 percent) compared to small (31 percent), but half or more firms across company size expect increased costs over 2019-2025.

RELOCATION POLICY CHANGES:

- Roughly four out of ten firms expect increases in relocation policy changes, both in 2018 and over the next eight years, to be driven by the legislation. Again, over the course of 2018, more mid-size and large firms feel this will be the case than small (42 and 52 percent vs. 28 percent), but expectations for increased changes to policy over 2019- 2025 are more similar across firm size.

COMPLEXITY OF RELOCATION ADMINISTRATION:

- Around four out of ten firms expect increases in the complexity of administration both in 2018 and over the next eight years. Expectations of increased complexity are similar across firm size both for 2018 and 2019-2025.

DIFFICULTY RECRUITING EMPLOYEES TO RELOCATE:

- Overall, around half of organizations don’t expect the tax reform law to have an effect either way regarding the difficulty of recruiting employees in 2018. However, more than a fourth of firms across company size expect this issue to cause difficulty, both in 2018 and the years beyond.

NUMBER OF RELOCATIONS PERFORMED:

- As for the projected impact of the new tax law on relocation volumes, the picture is immensely mixed. While nearly equal percentages overall expect increased or decreased relocations in 2018, around half expect levels to remain the same. Interestingly, for 2018, more large companies project a decrease than an increase (24 vs. 14 percent), while more midsize firms expect an increase rather than a decrease (34 vs. 15 percent) due to the legislation.

- When looking toward 2019-2025, projections across company size shift in favor of tax reform increasing volumes. Around a third of firms across sizes project increased relocation volumes, compared to roughly one out of ten projecting a decreasing effect.

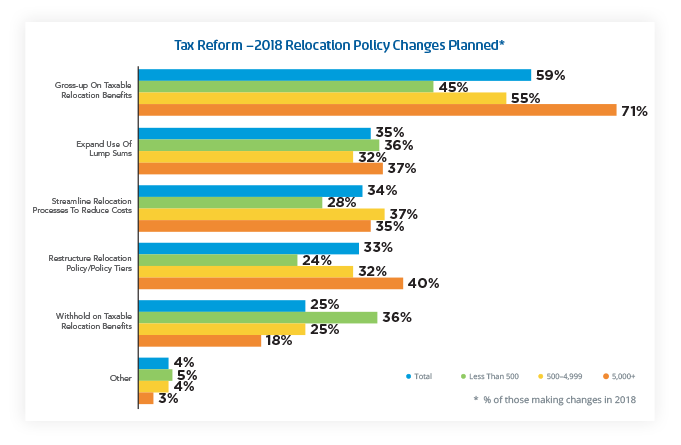

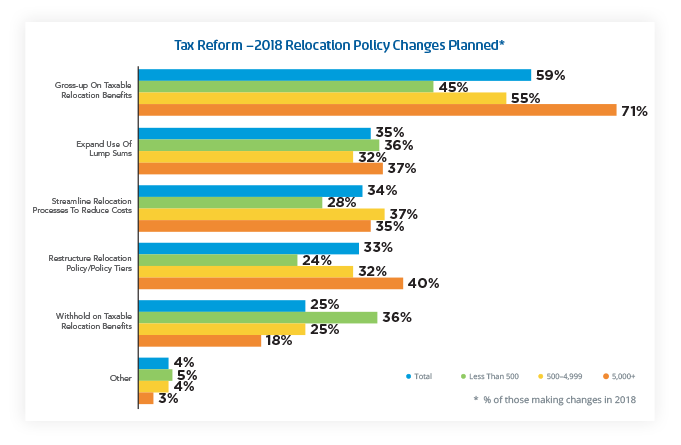

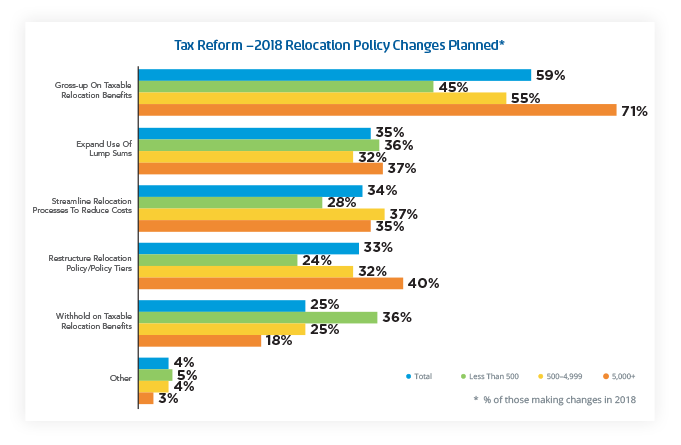

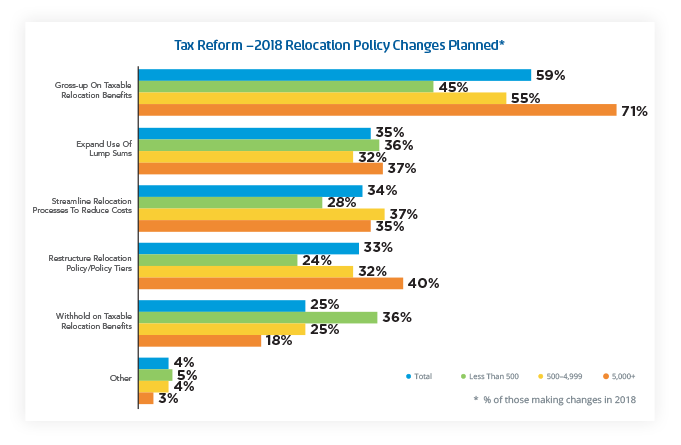

Policy changes planned for 2018:

The majority of organizations, regardless of size, have plans to implement policy changes in response to the tax law. Understandably, mid-size and large firms are more likely to have plans in place than are small firms (78 and 87 percent vs. 58 percent).

- Among organizations making policy changes in 2018 in response to U.S. tax reform, the most popular tweak across organization size is to gross-up taxable relocation benefits. However, large firms are the most likely to make this policy change.

- Around a third of firms plan to expand the use of lump-sums.

- Roughly a third or more of mid-size and large firms plan to streamline relocation processes to reduce costs and/or to restructure relocation policy, compared to around a fourth of small firms.

- Small firms are more likely than larger firms to plan to withhold on relocation benefits.

Proven Adaptability

The relocation industry shows dexterity – adapting to the sudden tax reform with speed and flexibility. While acknowledging challenges both in 2018 and beyond, relocation professionals appear to view the future with optimism. From their perspective, the law’s twists are manageable and will not deter them from finding the best policies and practices for their organizations and employees.