RELOCATION POLICY

Under Pressure – Adaptability & Budgets

The COVID-19 pandemic required unprecedented flexibility across industries, with relocation one of the most impacted. Nearly all firms made changes last year to relocation policies/programs due to COVID-19, expect to do so again in 2021, and requested additional COVID-specific services from providers to meet employee needs. The use of more adaptive relocation policy and practice while keeping costs contained became best practice after the economic challenges faced in the Great Recession. Assignment type versatility, candidate vetting, and multiple policy types continue to provide methodology options and guardrails. Fixed/flex policy, additional incentives, and cost containment strategies also allow companies to continue to flex their adaptive muscles and keep their talent mobile.COVID-19’S IMPACT – POLICIES & PROVIDERS

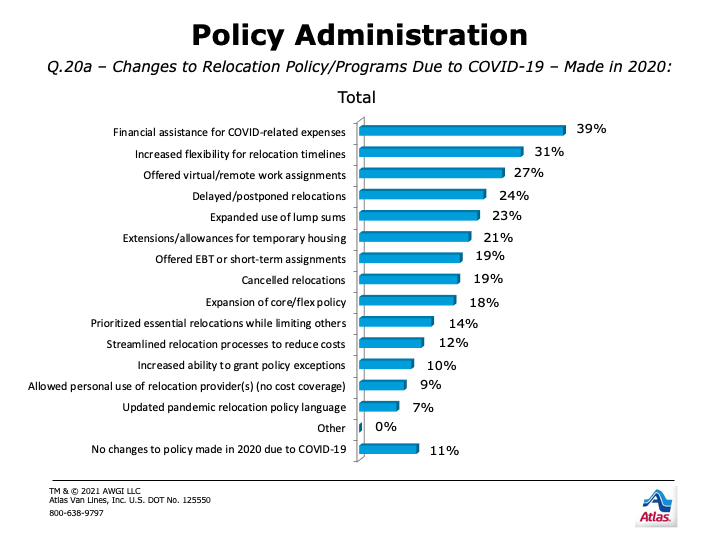

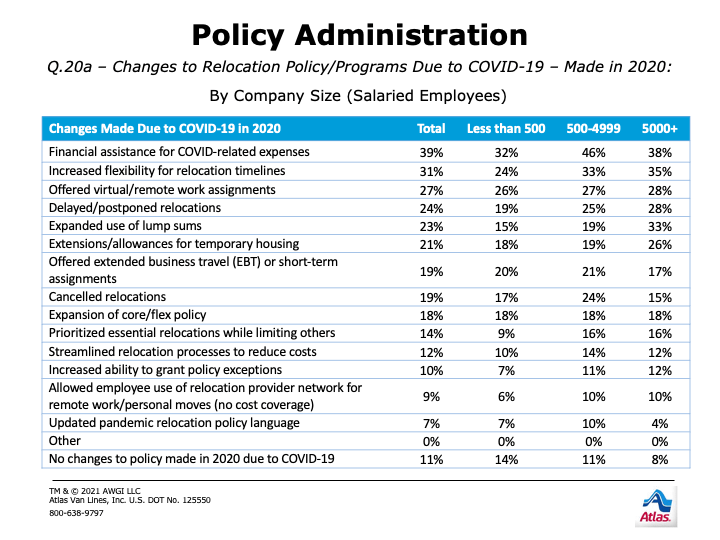

9 out of 10 firms responding made changes to relocation policy/programs due to COVID-19 last year. The most frequent changes were financial assistance for COVID-related expenses (39%) and increased flexibility for relocation timelines (31%). One out of four companies say they offered virtual/remote work assignments, delayed/postponed relocations, or expanded use of lump sums as well. One out of five provided extensions/allowances for temporary housing, offered extended business travel (EBT) or short-term assignments, or canceled relocations altogether.

- Midsize firms are the most likely to have offered financial assistance for COVID-related expenses (nearly half say they did so).

- One out of three midsize and large firms increased flexibility for relocation timelines; only a fourth of small firms did so.

- One out of three large firms expanded the use of lump sums in response to the pandemic, roughly twice as often as smaller firms.

- One out of four midsize firms canceled relocations and are the most likely to say they did so as a policy change in 2020.

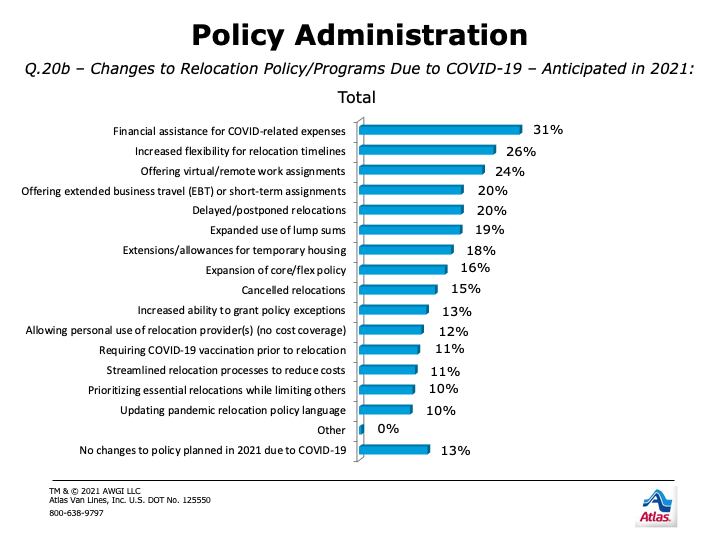

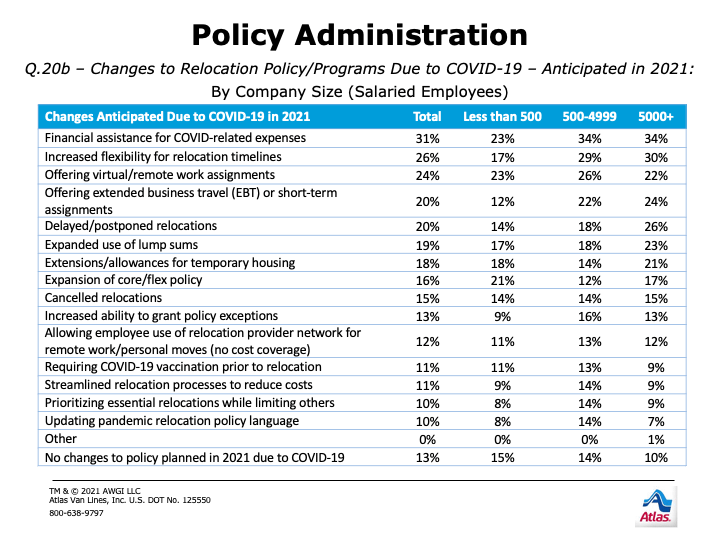

9 out of 10 firms responding anticipate having to make additional changes to relocation policy/programs due to COVID-19 in 2021. The most anticipated change is offering financial assistance for COVID-related expenses (31%). One out of four companies say they anticipate increasing flexibility for relocation timelines or offering virtual/remote work assignments as a shift in policy this year. One out of five expect to offer extended business travel (EBT) or short-term assignments, delay/postpone relocations, or expand lump sum use as well.

- Both midsize and large firms expect to offer financial assistance for COVID-related expenses, increased flexibility for relocation timelines, and EBT or short-term assignments far more often than small firms (34% vs. 23%, 29%+ vs. 17%, & 22%+ vs. 12%, respectively).

- One out of four large firms expect to delay/postpone relocations, more often than smaller firms.

- One out of four firms across company size anticipate offering virtual/remote work assignments as a policy/program change this year.

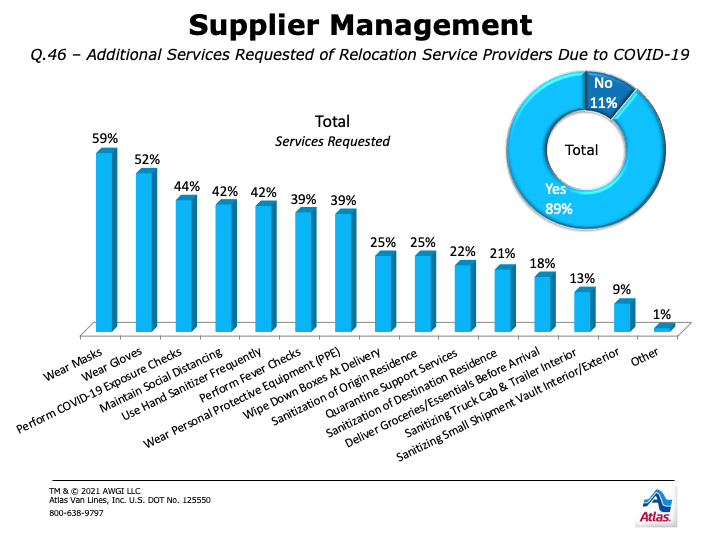

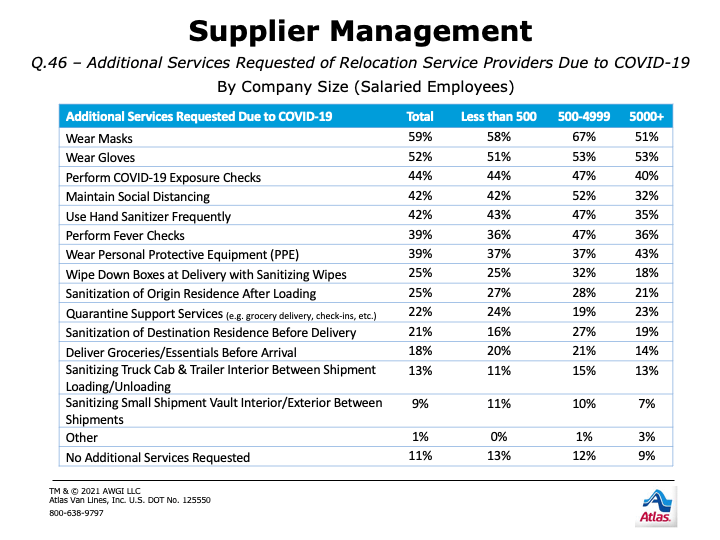

9 out of 10 firms say they asked relocation providers to perform additional services to meet employee needs due to COVID-19. More than half asked relocation service providers to wear masks and/or gloves, and nearly half requested the performance of COVID-19 exposure checks, social distancing, and frequent hand sanitizer use. More than a third asked that personal protective equipment (PPE) be worn and fever checks be performed. One out of four requested that boxes be wiped down at delivery and that origin residences be sanitized after loading.

- Midsize firms were the most likely to ask for mask wearing, social distancing, and fever checks compared to both larger and smaller firms.

- More than half of firms across size asked service providers to wear gloves.

MULTIPLE POLICY TYPES & PRACTICES LEVERAGED; TRADITIONAL ASSIGNMENTS REMAIN THE MAJORITY

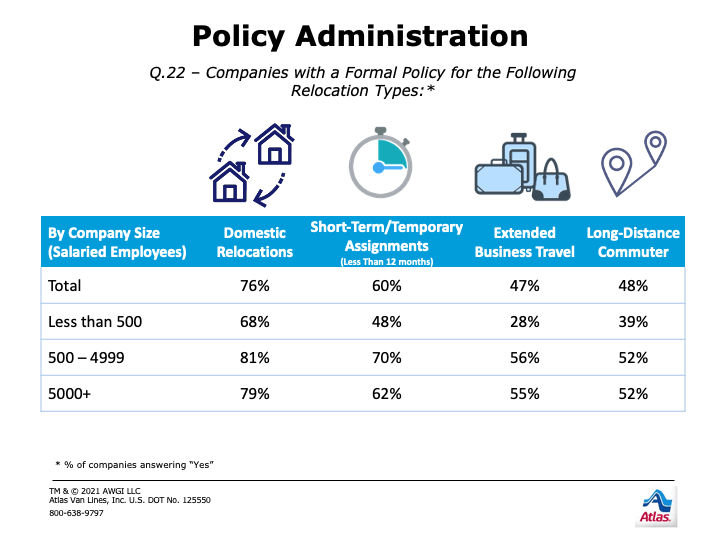

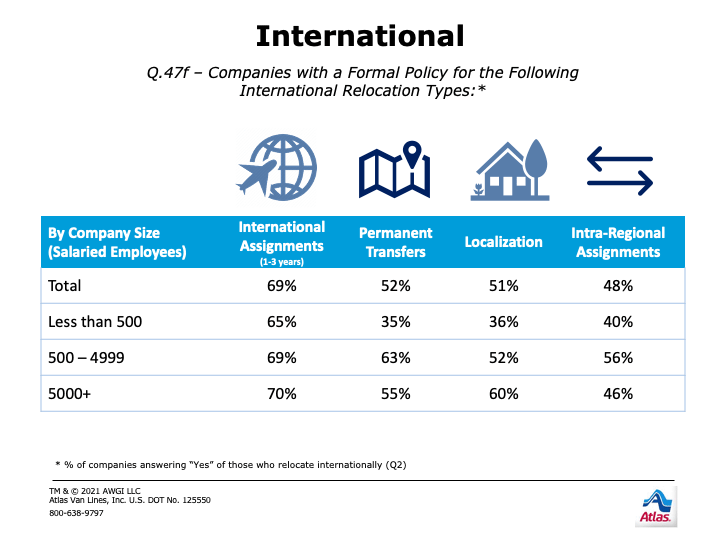

Relocation programs remain quite diverse. As in the past several years, the majority of relocation professionals manage policies for domestic (76%) and international relocations (69%), along with policies for short-term/temporary assignments (60%), permanent international transfers (52%), and international localization (51%). Essentially half maintain intraregional (international) (48%) and extended-business travel policies (47%) or have a policy for long-distance commuter arrangements (48%).

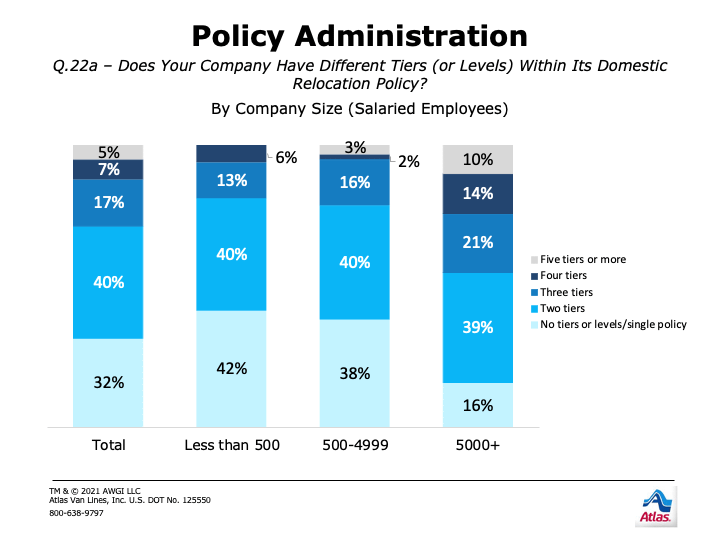

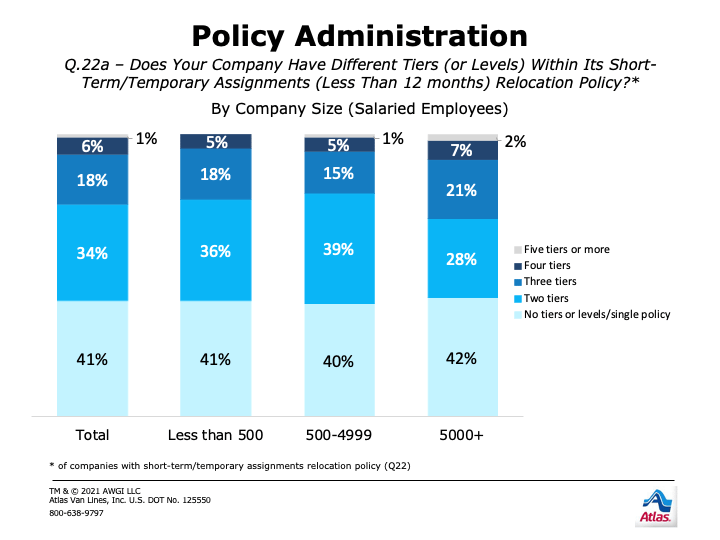

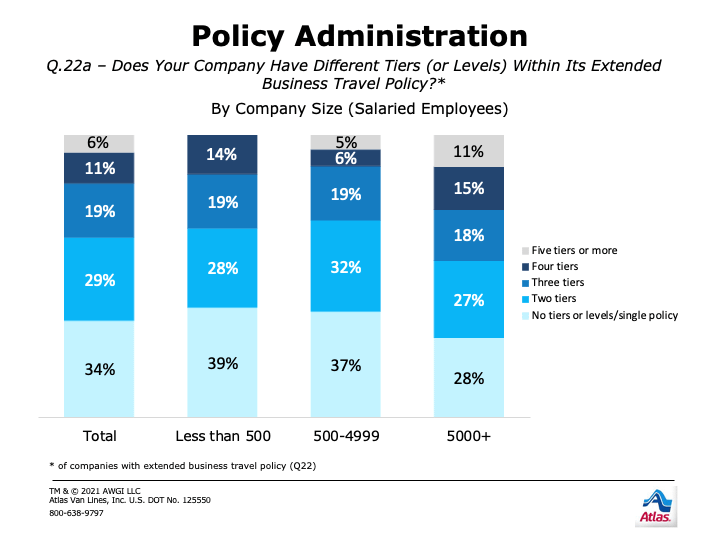

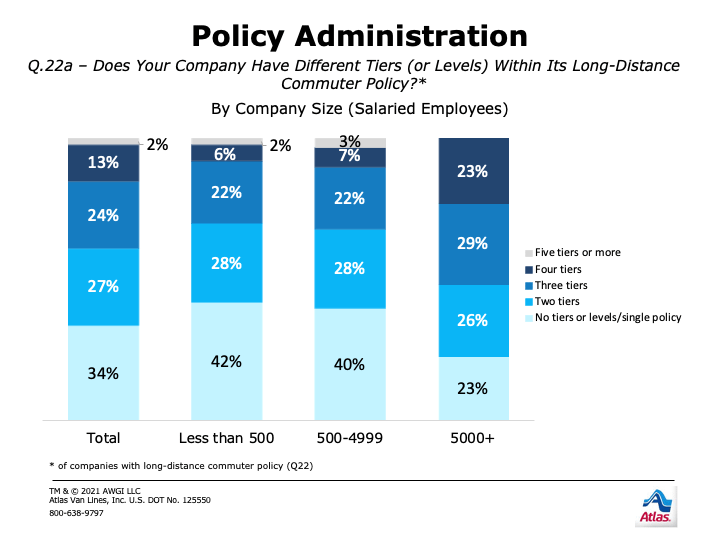

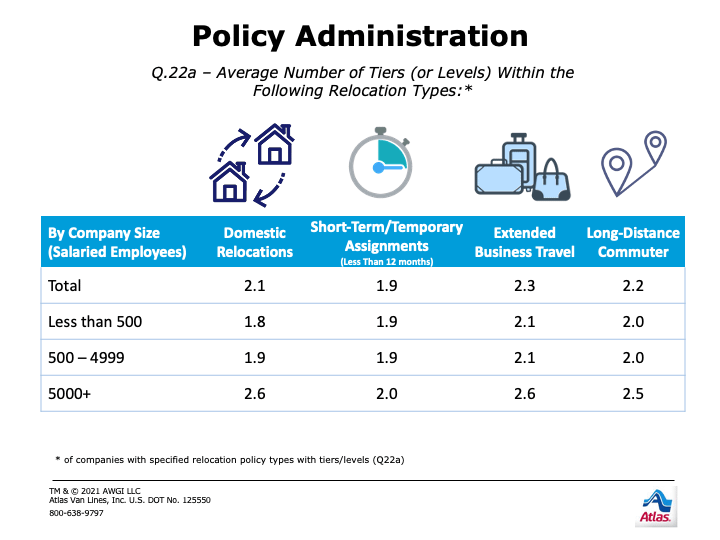

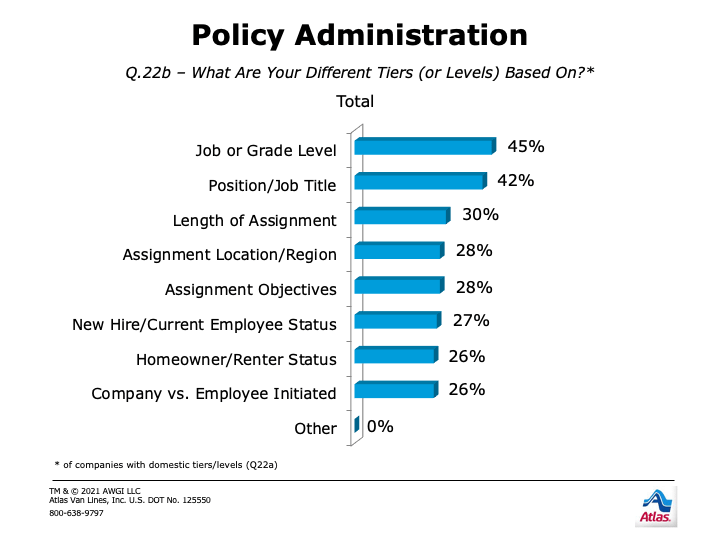

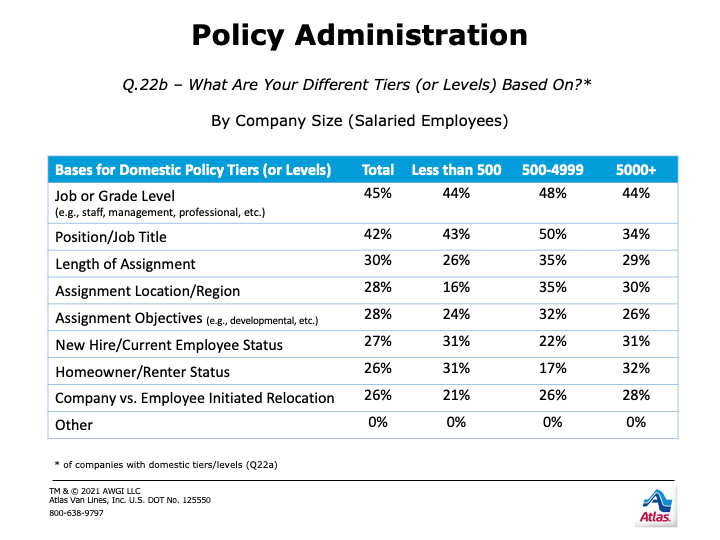

Most firms continue to define levels, or tiers, within policies. The larger the firm, the more likely its overall domestic policy includes levels. Firms using levels manage essentially two or more such policies on average, across company size, for both domestic and international relocations. Levels are based on a variety of factors; however, the top two domestically, across firm size, are job/grade level and position/job title. Job/grade level is essentially equal in weight to position/job title at midsize (48% vs. 50%) and small (44% vs. 43%) firms, while job/grade level outweighs position/job title at large firms (44% vs. 34%). Domestically, homeowner/renter status is more likely to be a consideration at small and large firms than midsize (31% & 32% vs. 17%), while assignment location is more likely to be a tier/level consideration at midsize and large firms than small ones (35% & 30% vs. 16%).

CANDIDATE ASSESSMENTS

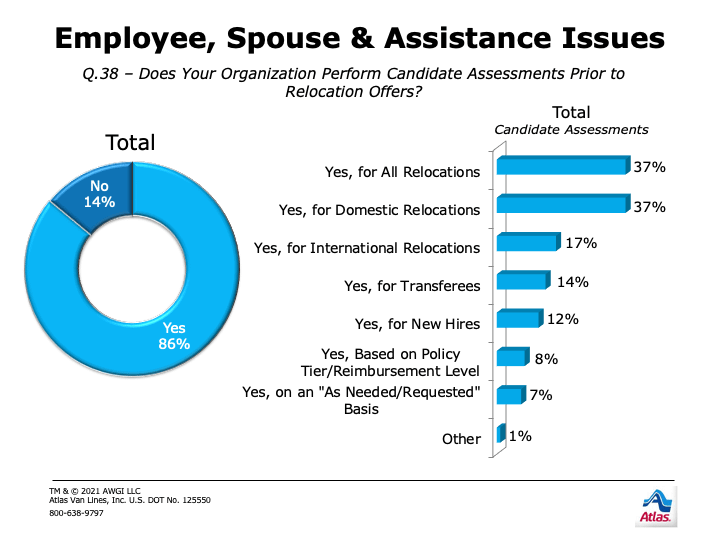

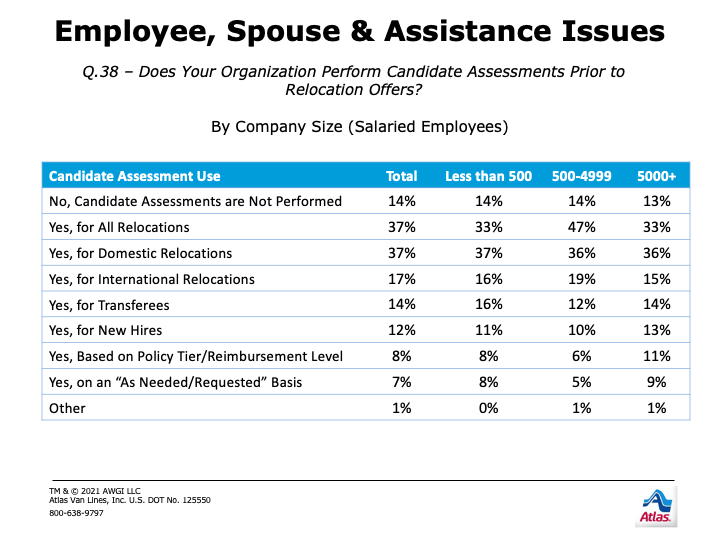

Over the last seven years, the majority of firms have used candidate assessments to support relocations. This year, 86% of firms assessed candidates prior to making offers, reaching a historical high for a second straight year. This percentage is similar to most recent years and maintains a marked increase over the roughly half of firms that assessed candidates from 2012 to 2014. Usage slightly surpasses the highest level recorded for midsize firms (86% vs. 85%: 2019), similar to 2020 (83%) and well above other recent years (74%+). Candidate assessment use exceeds the highest level recorded for small firms (86%), similar to last year’s prior historic high (78%) and notably above 2018-2019 (67% & 72%, respectively). Usage also surpasses the previous high recorded for large firms last year (87% vs. 76%), remaining dramatically above 2018- 2019 (54% & 64%, respectively).

- Roughly half of midsize firms perform candidate assessments for all relocations; one out of three small and large firms do so.

- Across company size, more than one out of three firms assess candidates for domestic relocations, which is roughly twice as often as the historical norms of the past six years.

The most popular method historically has been performing assessments for all relocations. This year, it is now matched by use for domestic relocations (37%) for the top spot. Performing assessments for all relocations remains similar to the past six years overall (37% vs. 38%-48%) and roughly double the 21% levels reported from 2012 to 2014. The decline appears to be largely driven by small firms, as only 33% performed candidate assessments for all relocations, a marked decline from 2015-2017 and 2019-2020 (43%-50%) and lower than 2018 (39%). However, it remains higher than in 2012-2014, when essentially one-fourth did. Assessments for all relocations among large firms remain similar to the past three years (33% vs. 29%-37%) but lower than 2015-2016 (42%+), albeit remaining roughly double the percentages seen in 2012-2014. Around half of midsize firms continue to perform candidate assessments for all relocations, similar to the previous six years and more than twice the historical rate.

FIXED BENEFITS/FLEX BENEFITS LIST-DRIVEN POLICY

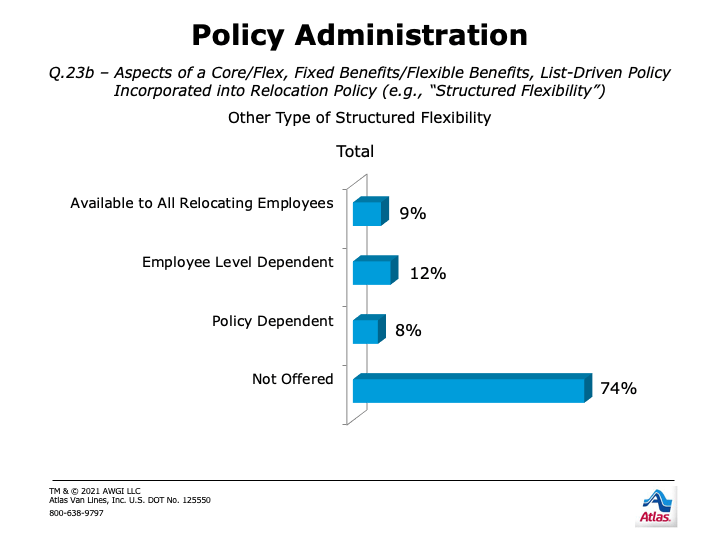

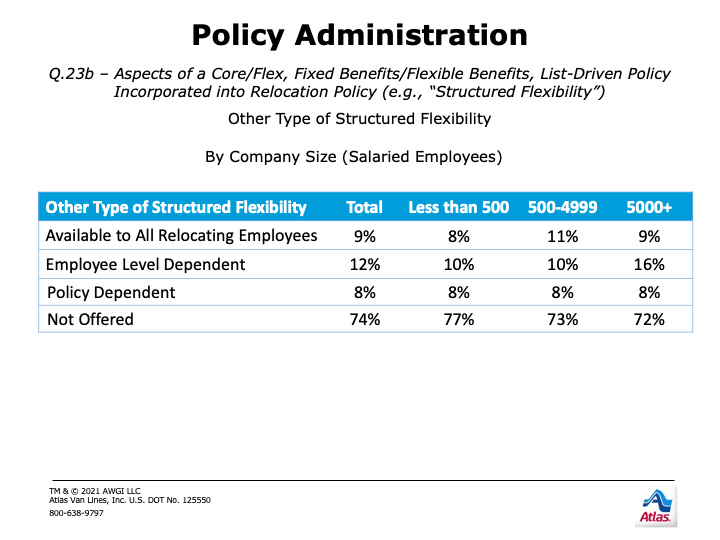

Over the past decade, built-in flexibility for relocation policies has become undisputed best practice. Many companies do this by identifying what relocation costs are considered “core coverage” or by allowing relocation funds to be used on select services from which an employee can choose. Stipulations by employee level and/or policy are often built in, while many companies simply make these types of flexibility available to all relocating employees.

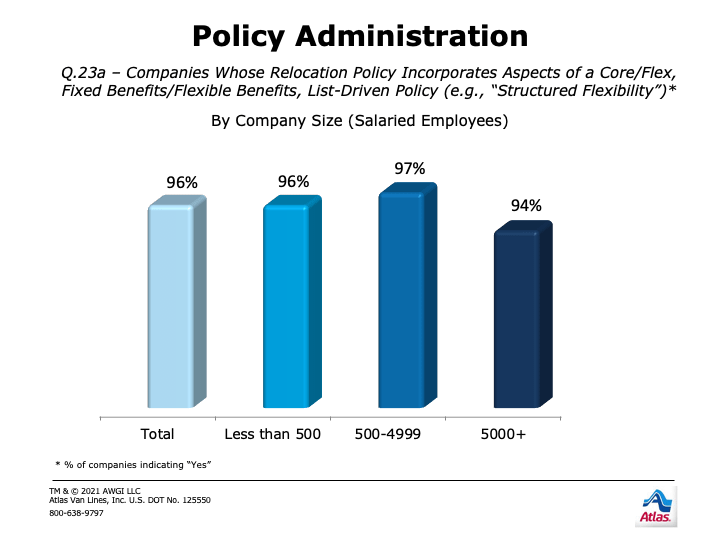

From 2015 to 2019, more than 80% of firms used aspects of fixed/flex policy, a marked increase from 2013-2014. Usage jumped to 96% in 2020-2021 and remains at 94%+ across company size for a second straight year. Offering some form of flexibility in how relocation benefits can be used is critical to meet the diversity of employee needs. The option to cover specific items as fixed/core benefits or allow flexible use of all or a portion of relocation benefits can be made available to all employees, be employee level dependent, or be policy dependent.

Coverage for core components remains the most popular option. However, allowing the flexible use of relocation benefit coverage amounts (either the full amount or a portion) sees far greater leverage than in years past.

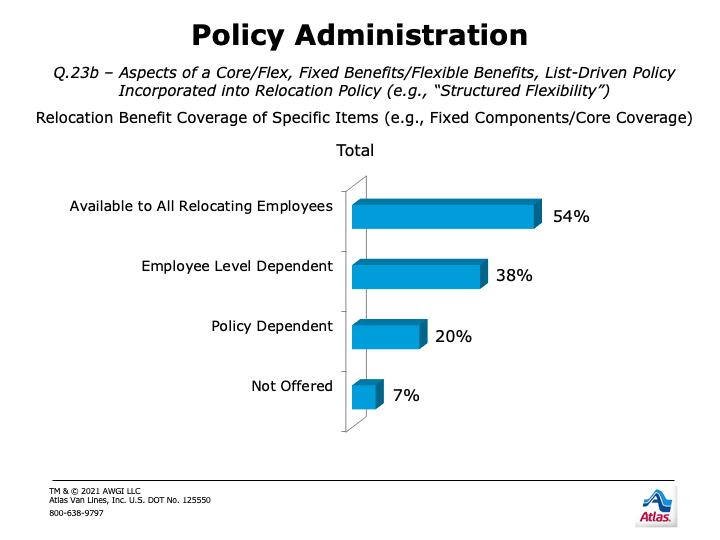

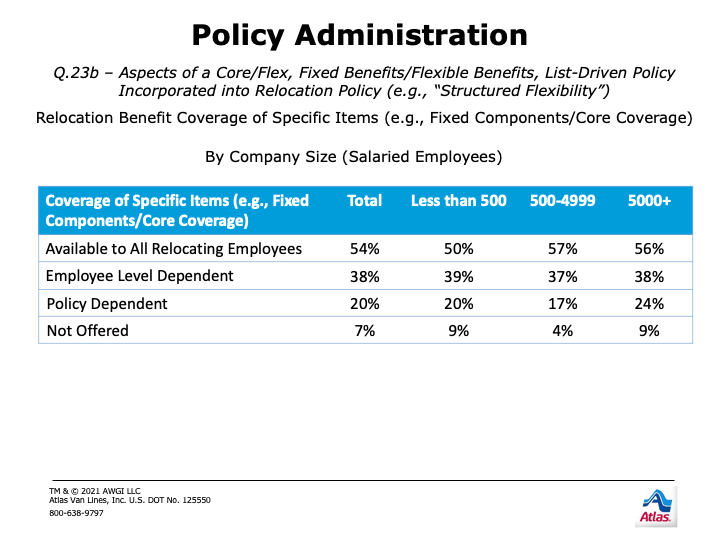

- More than half of firms say they offer the coverage of specific items in relocation for all employees, matching the high in 2015 and 2020 (54%). Across company size, half or more of firms indicate doing so. Use of policy level dependent coverage doubles at small firms (20% vs. 11%) compared to 2020 but remains essentially the same at midsize and large. 4 out of 10 firms across size say the coverage of specific items in relocation can also be employee level dependent, and less than 10% of firms across size say it is not offered in any capacity.

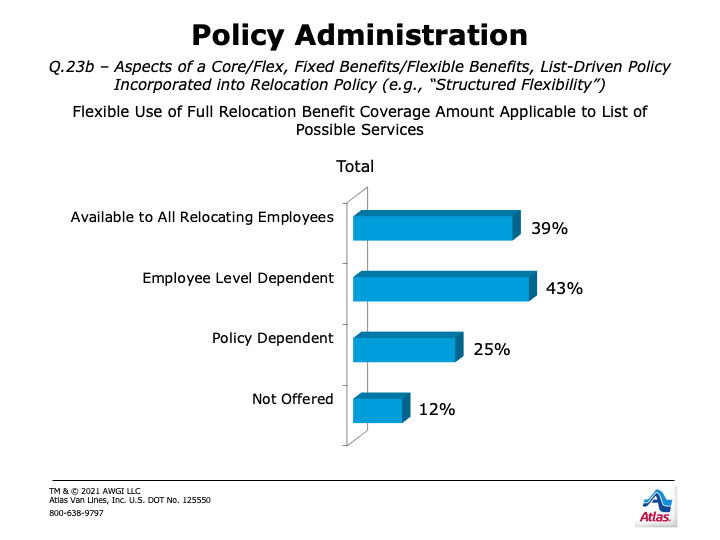

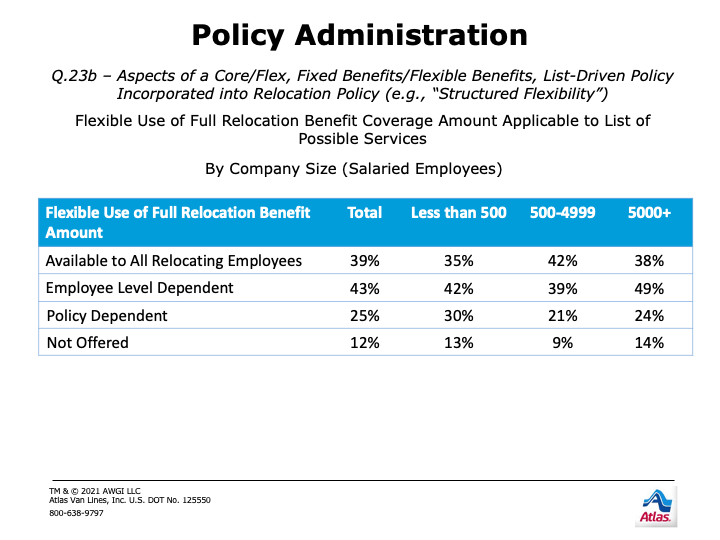

- 4 out of 10 firms say flexible use of the full relocation benefit amount is offered to all employees or is employee level dependent. Large firms are the most likely to make full benefit availability employee level dependent (49%) rather than offering it to all (38%) or making it policy dependent (24%). Small firms are more closely split between these options, while midsize firms are more likely to offer it to all or based on employee level. One out of five midsize firms say flexible use is policy dependent, while around a tenth of firms overall say it isn’t offered at all.

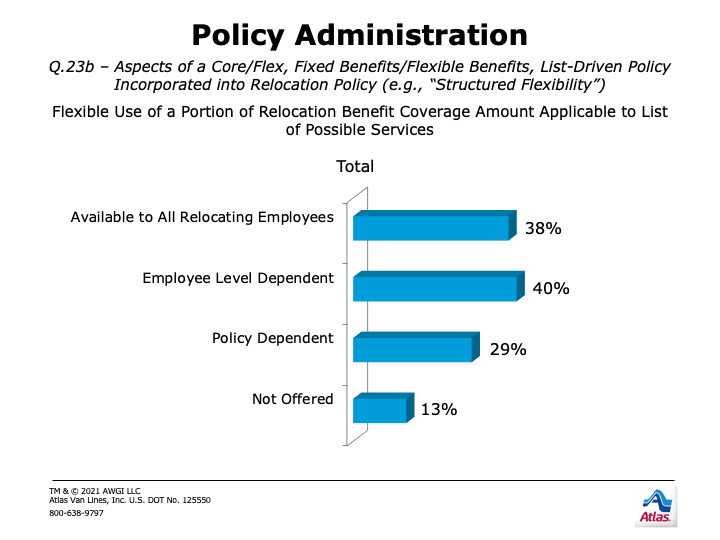

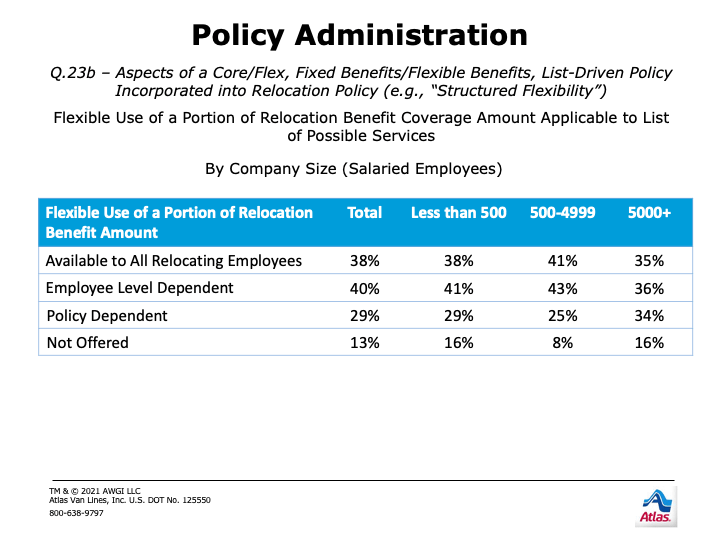

- Having the option to flexibly use a portion of relocation coverage is offered by around 4 out of 10 firms across size to all employees or is employee level dependent. One out of three large firms say this is likely to be policy dependent, compared to around a fourth of smaller firms. One out of eight don’t offer this kind of flexibility in any capacity.

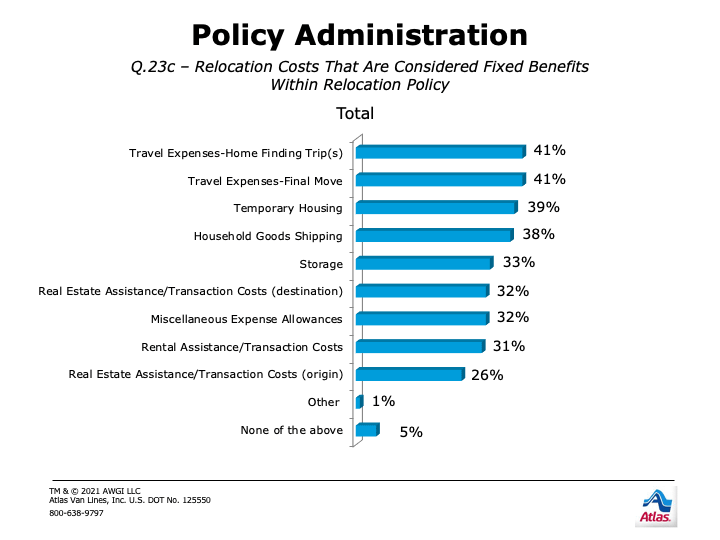

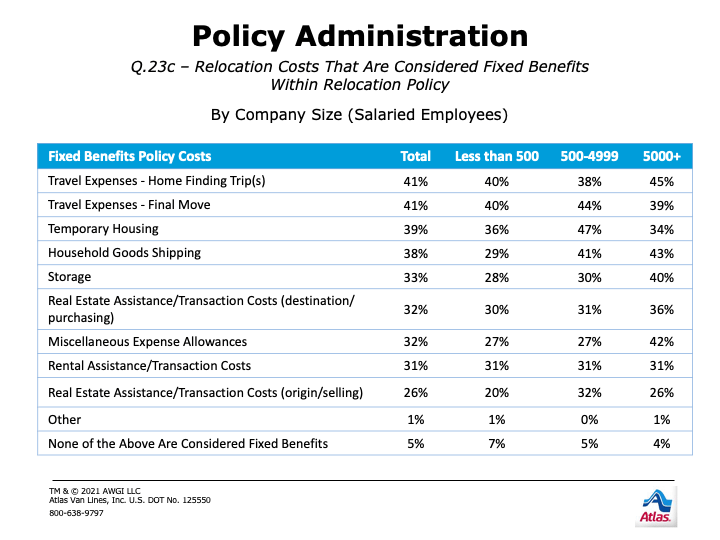

Coverage of core components remains the most popular aspect of fixed/flex policy. For a sixth year, we dug deeper into what falls into this category. Overall, the top components continue to be travel expenses—final move (41%), travel expenses for home-finding trips (41%), temporary housing (39%), and household goods shipping (38%)—but the percentage covering these items declines notably compared to the previous four years of comparable data for all but home-finding trips. The percentage of companies offering real estate sales assistance as a fixed benefit is also markedly lower compared to the past four years (26% vs. 32%-41%), and those offering miscellaneous allowances and storage are slightly lower as well.

- Large firms are more likely than midsize or small to consider storage and miscellaneous allowances core benefits, while both midsize and large firms are more likely to view household goods shipping as a core benefit than small.

- Far more midsize firms view temporary housing as a fixed benefit compared to large or small firms, and midsize firms are the most likely to view real estate sales costs as a fixed benefit.

- Coverage is similar across firm size for home-finding trips, the final move, real estate purchase costs, and rental assistance.

INCENTIVES

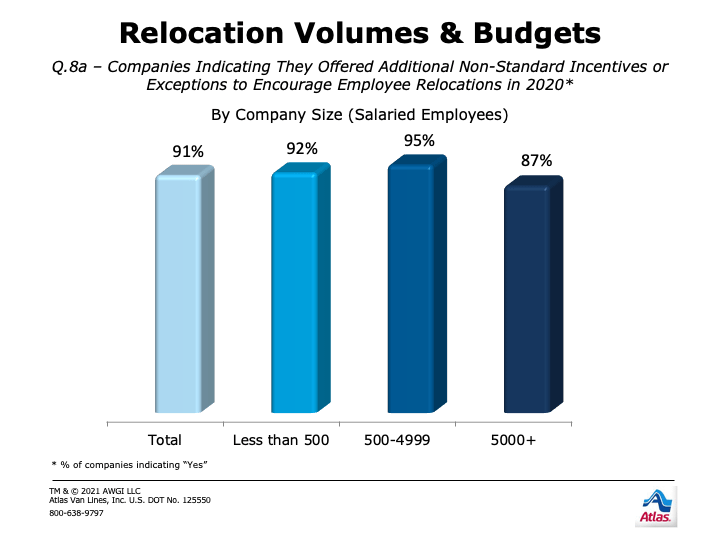

In addition to having flexibility in policy, the ability to use additional incentives to persuade key employees to take relocation assignments remains crucial. Over the past seven years, most firms across company size indicate they are offering additional, non-standard incentives or policy exceptions. Since 2008, the overall use of incentives/exceptions has grown more than 30% (91% vs. 60%: 2008).

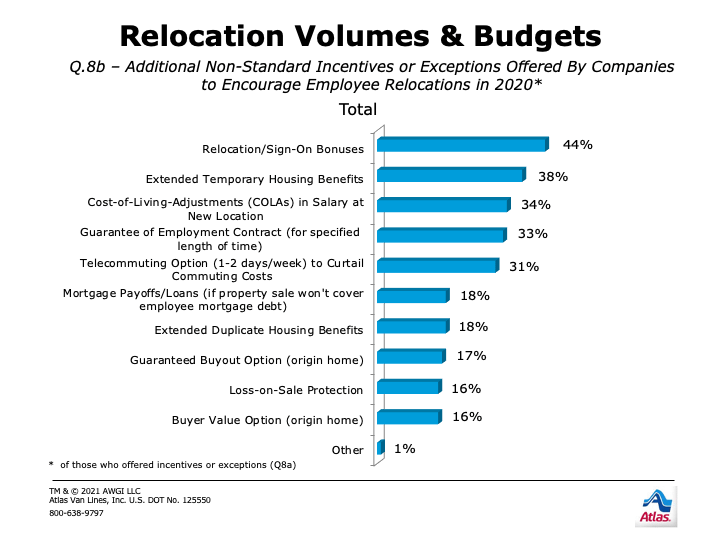

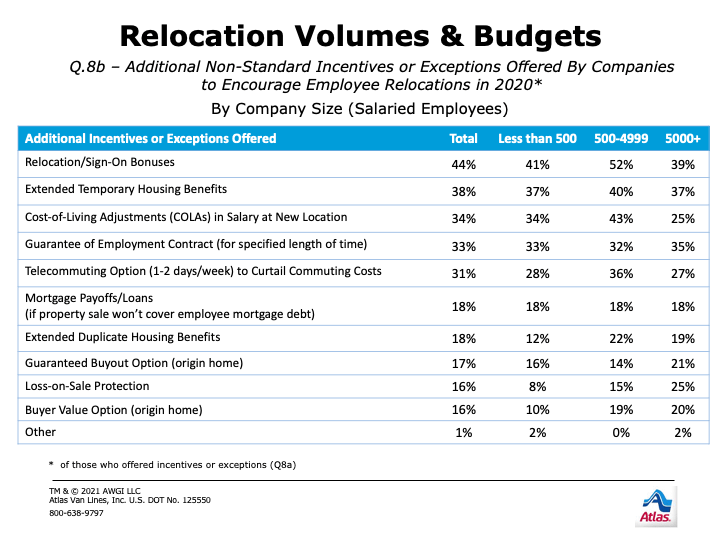

- Relocation/sign-on bonuses remains the number one incentive for a third year across company size. However, at both small and large companies, extended temporary housing benefits is a close second.

- Both extended temporary housing benefits and cost-of-living adjustments (COLAs) round out the top three incentives at small and midsize firms. At large firms, a guarantee of employment contract (for a specific length of time) is more popular than COLAs.

- The percentage of firms offering extended temporary housing benefits last year falls to a historic low, roughly half that of when measurement began (38% vs. 72%: 2013). While relocation/sign-on bonuses and COLAs being offered trend notably lower, their declines are not as dramatic.

- More than half of midsize firms offered relocation/sign-on bonuses, similar to last year (52% vs. 56%) and far more often than small or large firms, which saw marked decreases (41% vs. 60%, 39% vs. 58%, respectively).

- Almost half of midsize firms used COLAs in salary; only 34% of small and 25% of large firms did so.

- Both midsize and large firms remain 2x or more likely than small to offer loss-on-sale protection or buyer value options for origin homes as incentives.

- A telecommuting option (1-2 days a week) was flexed by around a third of firms and at similar levels across company size.

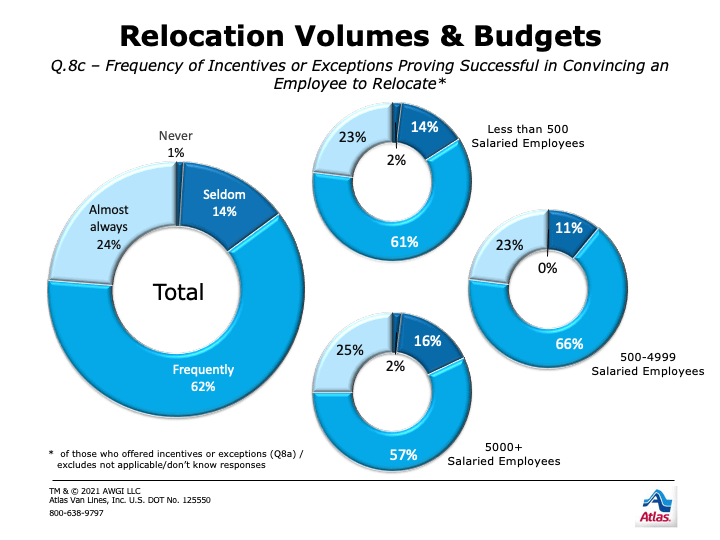

Incentives continue to prove highly successful; essentially 9 out of 10 firms report incentives work almost always or frequently, consistent with historical levels. Combined with usage at such high levels, this data indicates that being able to flex in this way is also essential for companies to mitigate employee reluctance to relocate and family considerations that place downward pressures on mobility.

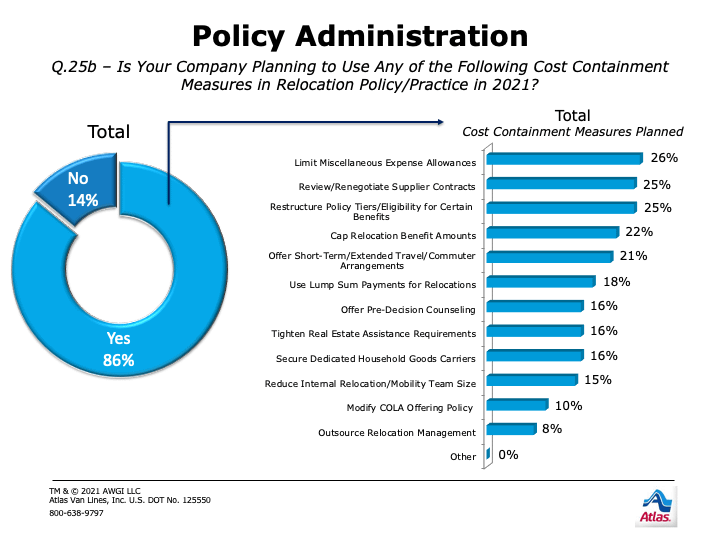

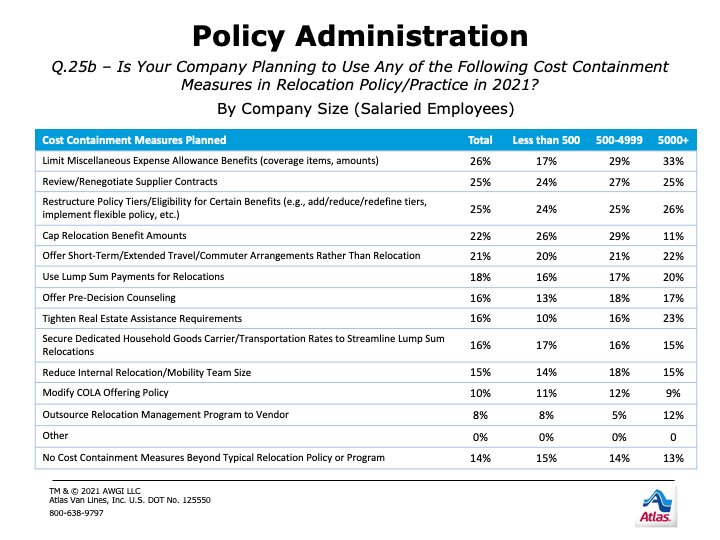

COST CONTAINMENT

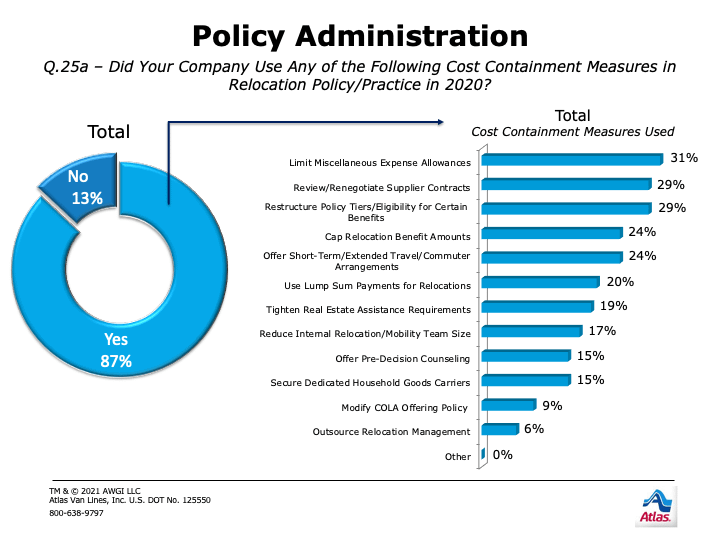

Even with built-in flexibility and high usage rates of incentives/exceptions, cost containment measures are also heavily utilized. The use of cost containment reaches another historical high, which shows the last seven years of near-constant elevated usage of these tactics to keep relocation budgets within scope is a widely accepted best practice. Prior to 2014, far fewer companies indicated using these types of measures, and those that did were far more likely to be large companies. Company size no longer plays a role, as overall usage is now similar across firms of all sizes. This year, we asked if companies planned to use cost containment tactics in 2021 as well, and current use and projected use stays nearly constant. Even while companies flex to move talent, they actively work to keep costs down.

From 2016-2019, the top cost containment method was using lump sum payments for relocations. Those using lump sums for cost control falls by nearly half in 2020 (20% vs. 40%) and is significantly lower than the prior four years. Planned usage remains far lower for 2021 as well, and this trend holds across company size. Lump-sum payments may no longer be viewed primarily as a cost control method but may simply provide other benefits for relocation management. One out of every four moves by firms participating in the survey is estimated to have been entirely paid for by lump sums, and it remains a popular reimbursement method for both transferees and new hires. For the first time, more than half of firms say they use lump-sum payments for short-term, temporary assignments, increasing for a third straight year (52% vs. 44% & 42%). Use of lump sums for international long-term assignments remains similar to the higher level of 2020 (35% vs. 40%), and the majority of firms continue to use lump-sum payments for domestic relocations.

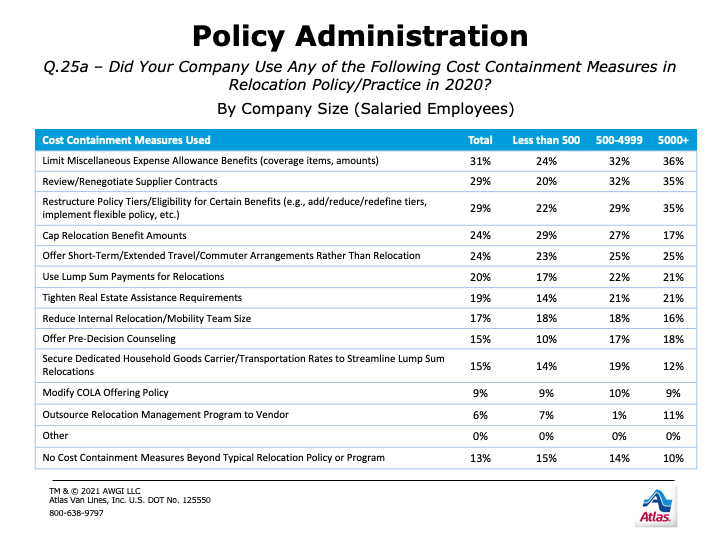

- The top method used to control costs was to limit miscellaneous expense allowance benefits in 2020. Large firms were the most likely to use this tactic (36%), followed by mid-size firms (32%). Small firms were much less likely to have done so (24%). Both midsize and large firms plan to use this option more often than small firms in 2021 to control costs (29% & 33% vs. 17%).

- Both midsize and large firms were more likely to review/renegotiate supplier contracts last year compared to small (32% & 35% vs. 20%). One out of four across company size plan to do so in 2021.

- Midsize and small firms were more likely to cap relocation benefits to contain costs in 2020 compared to large firms (27% & 29% vs. 17%). This holds true for 2021 as well (29% & 26% vs. 11%).

- Large firms were more likely to restructure policy tiers/eligibility for benefits last year compared to small firms (35% vs. 22%). However, one out of four across company size plan to do so in 2021.

- One out of four firms across size say they offered short-term/extended travel/commuter arrangements rather than relocating employees in 2020 as a cost containment measure. Similar percentages plan to do so in 2021.

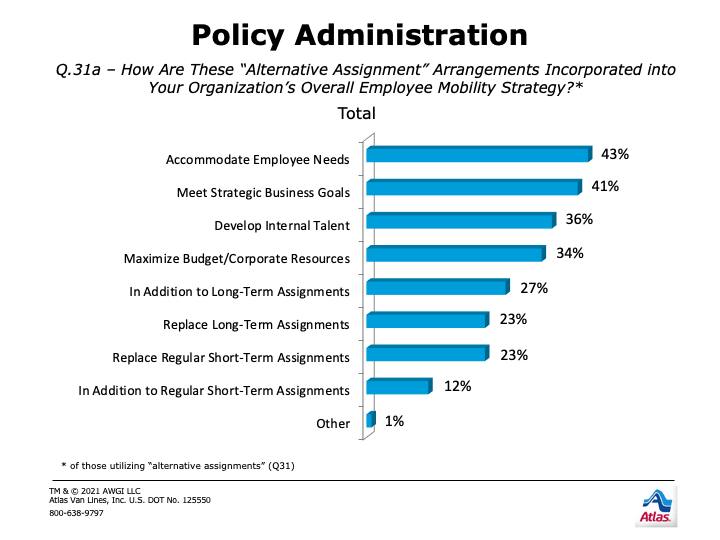

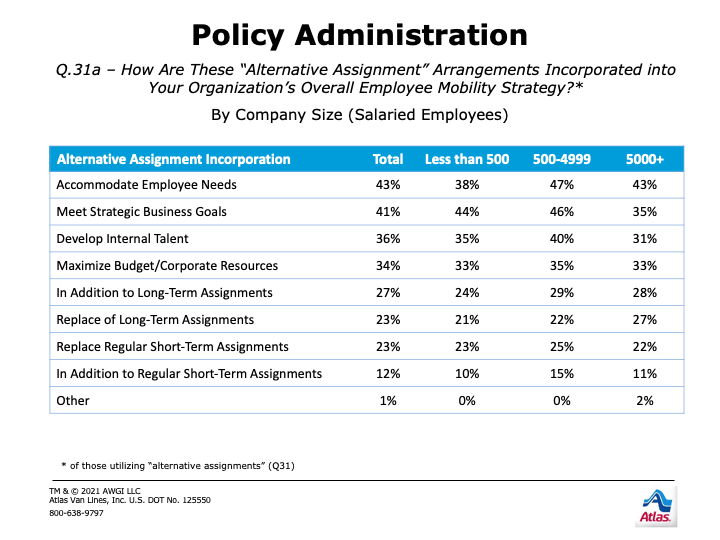

Accommodating employee needs is the top reason for using alternative assignments this year.

ALTERNATIVE ASSIGNMENTS

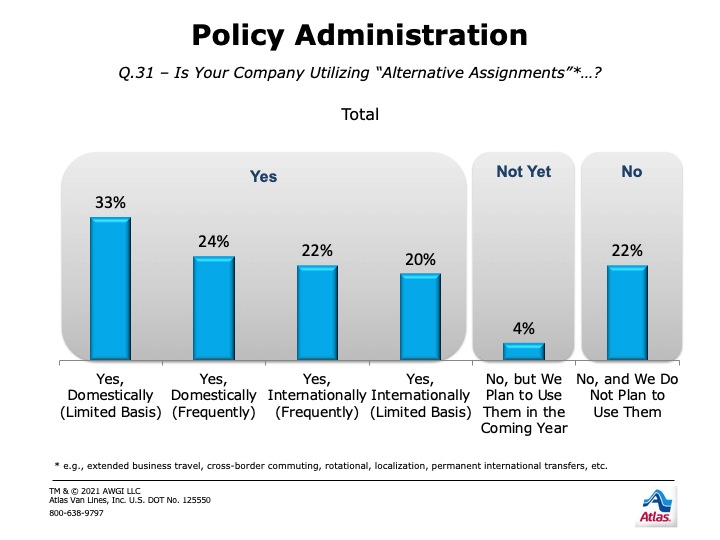

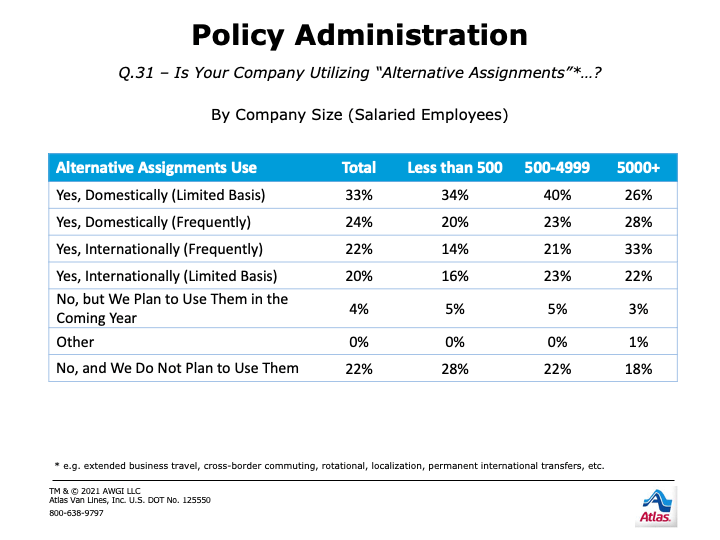

Over the last seven years, most firms have come to rely on other arrangements to supplement traditional relocations. More than three out of four (78%) firms state they use alternative assignments, reaching a historic high for a second straight year. This is an increase over the past six years (61%-71%) and far more often than during 2012-2014. The percentage of large firms using such arrangements reaches a historic high (82%), similar to 2018 & 2020 (78% & 77%), above 2015-2017 & 2019 (68%-74%), and far above 2012-2014 (60%-66%). Usage among midsize firms remains at last year’s historic high (78%), roughly twice that of 2014 (37%) and surpassing 2015-2019 levels (64%-75%). Increasing for a third straight year past the previous historic high (72% vs. 59%: 2017, 2020), usage among small firms is the highest ever measured, notably above 2015-2016 & 2019 (48%-54%), 2018 (40%), and more than three times that of 2014 (19%).

The methods for incorporating alternative assignments into policy vary widely. Such arrangements were birthed to meet strategic business needs geographically without incurring the costs of traditional relocations. In the past, the overwhelming policy driver was accomplishing strategic business goals.

This falls to second place, with accommodating employee needs the top reason this year. With the COVID-19 pandemic presenting so many different challenges, this simply makes sense. Fewer companies indicate using them to replace long or short-term assignments or in addition to these assignment types, but slightly more say developing internal talent or maximizing budget/corporate resources is a key driver

- Meeting strategic business goals edges out employee needs accommodation at small firms for the top reason for alternative assignment use (44% vs. 38%); the reverse is true at large firms, with accommodating employee needs in the top spot (43% vs. 35%). These are essentially equally weighted at midsize firms (47% & 46%).

- A third or more of firms use alternative assignments to develop internal talent or maximize budget/corporate resources across company size.

- One out of four firms use these in addition to long-term assignments across company size, and roughly one out of four use them as replacements for either long-term or short-term assignments.

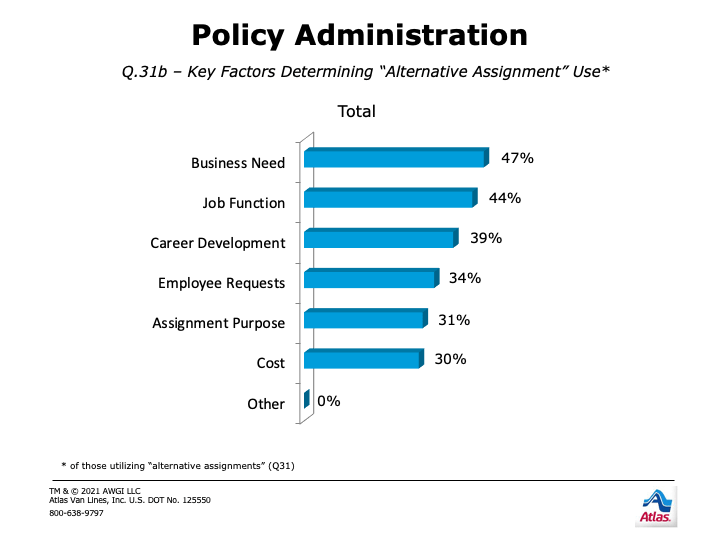

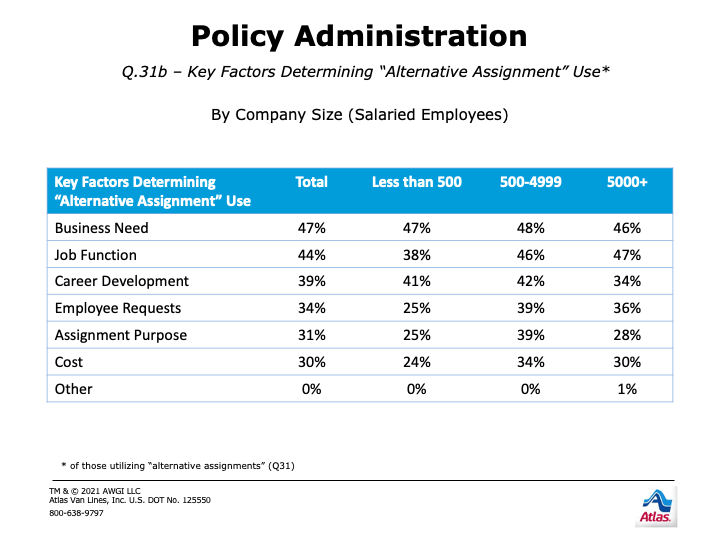

Overall, the top two factors in determining whether alternative assignments are brought into play are business need (47%) and job function (44%), cited by roughly half of firms overall. Interestingly, assignment purpose and cost had historically been cited around half of the time as key factors for alternative assignment use, and these percentages fall to around a third overall. Moving up to the number three spot is career development (39%), cited slightly more often than prior years and part of the top three reasons for leveraging these assignment types for the first time.

- Among large firms, job function (47%) and business need (46%) are nearly tied as the top considerations. Employee requests and career development are equally weighted for second place (36% & 34%).

- At midsize firms, the top factors are nearly equal as well between business need (48%) and job function (46%); however, career development (42%), employee requests (39%), and assignment purpose (39%) are closely rated secondary factors, and around one-third rate cost as pivotal.

- At small firms, the top factor is business need (47%), but second place goes to career development (41%) rather than job function (38%).

- Midsize and large firms say employee requests are a key factor in alternative assignment use far more often than small firms (39% & 36% vs. 25%), and midsize firms are the most likely to say assignment purpose plays a role.