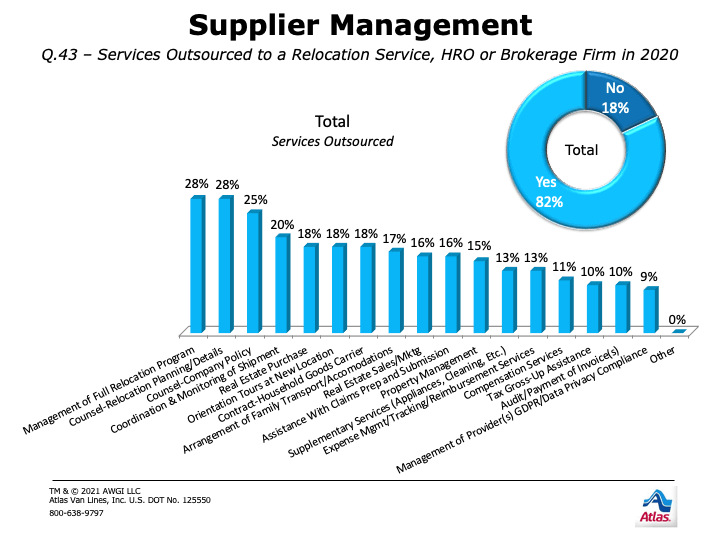

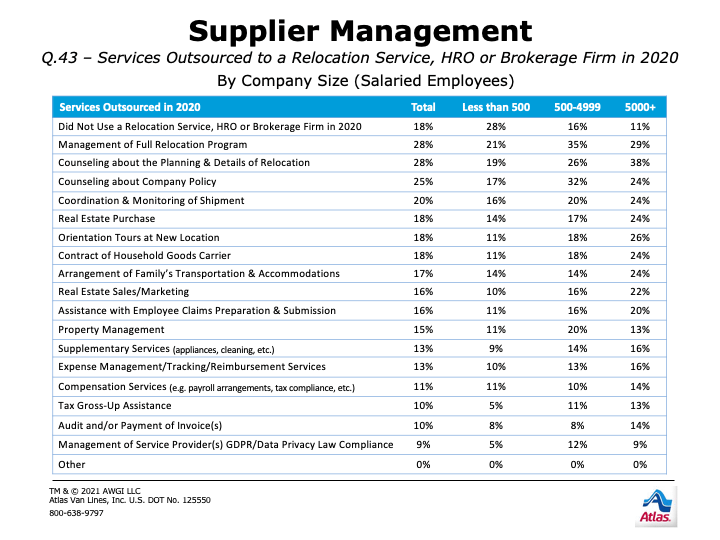

OUTSOURCING

More than 80% of companies outsourced relocation services last year. This number surpasses the historical high of 2016 & 2020 (82% vs. 77%) and all other highs in 2011, 2014-2015 & 2018 (72%-76%). Outsourcing continues for the overwhelming majority of large firms (near highest levels historically) and in the high range for midsize firms. Usage among small firms reaches a new historical high (72%), notably above 2015-2016 & 2018-2019 (59%- 65%) and 2017 (49%). It is now roughly double the previous 12-year average of around one-third. Large firms continue to outsource to a greater extent and offer more services than midsize or small firms.

Even with more firms continuing to outsource overall in 2020, the use of most individual service categories is similar to 2017-2019 and remains slightly lower compared to 2016. However, worth noting is that outsourcing full relocation program management has increased over the past three years (28% vs. 22%+) and is just over 2016 levels (26%). Four categories see declines by roughly half compared to both last year and 2016: real estate sales/marketing (16% vs. 33%+), real estate purchase (18% vs. 31%+), tax gross-up assistance (10% vs. 21%+), and expense management/tracking/reimbursement services (13% vs. 21%+). Overall, most service categories remain down from historical highs and at or near historic lows. The management of service provider GDPR/data privacy compliance is newer: 1 out of 10 firms outsources this function. Companies remain extremely strategic, using external expertise only where it is most cost effective, as evidenced by high overall outsourcing but not across service categories.

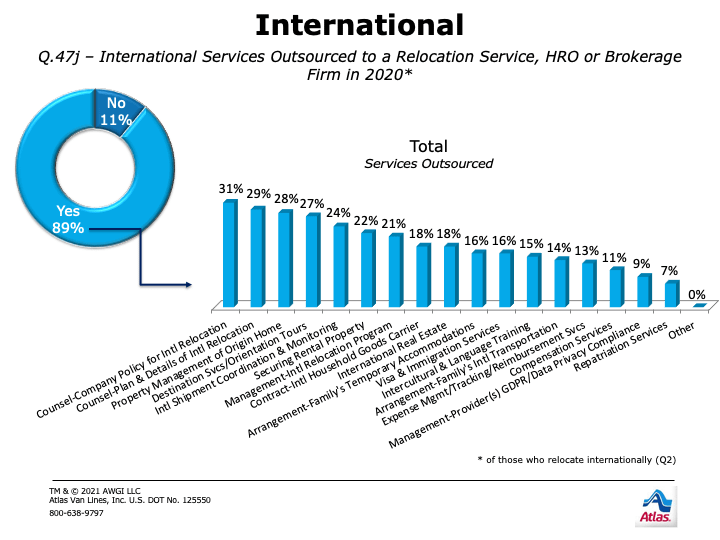

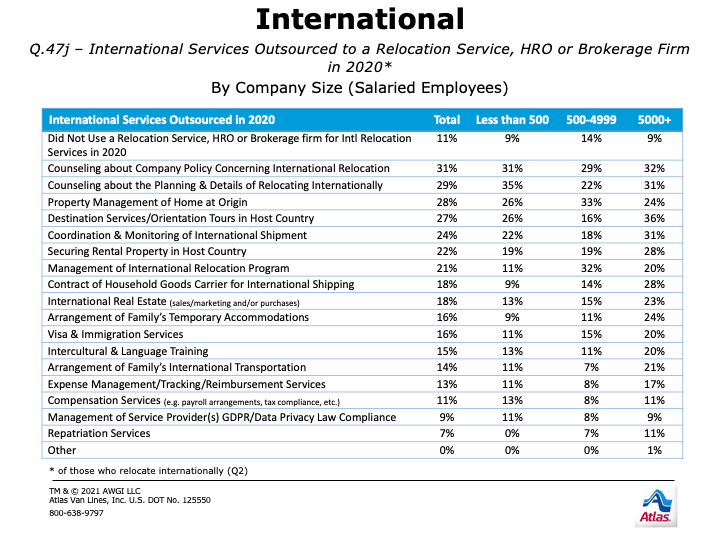

INTERNATIONAL

Similar to the previous seven years, more firms relocating employees internationally outsourced in 2020 than did overall (89% vs. 82%). International outsourcing remains at or close to historic highs overall and across company size, but with great variation across service categories. However, large firms continue to outsource a greater variety of services than midsize and small firms do.

In 2020, international outsourcing across most service categories declines from the higher levels seen in 2018-2019 and falls below the lower levels of 2017. Outsourcing levels fall to or near the lowest levels historically for most categories. There are two exceptions:

- Counseling about company policy concerning international relocation remains similar to 2016 & 2019 (31% vs. 34%+), above 2017-18 (24%+), and in the midrange historically.

- Outsourcing the property management of the origin home nearly matches the historical high (28% vs. 29%: 2013), is markedly above 2017-2019 (17%+), and is similar to higher historical norms overall.

Outsourcing categories that stay at or near 2017 levels are: counseling about the planning and details of relocating internationally (29% vs. 29%), international shipment coordination and monitoring (24% vs. 29%), destination services/orientation tours (27% vs. 30%), and international real estate services (18% vs. 14%). Since international relocation volumes took the greatest hit due to the COVID-19 pandemic, the decline in the outsourcing levels of many international relocation services is not wholly unexpected. Among companies that outsourced relocation services domestically in 2020, those that also outsourced internationally (98%) matches 2014’s historical high. For the seventh straight year, firms that outsource domestic services and relocate internationally almost universally outsource services abroad. Large firms continue to be the most active for outsourcing internationally: around one-fifth or more did so across almost all survey categories.