INTERNATIONAL ASSIGNMENTS

DURATION

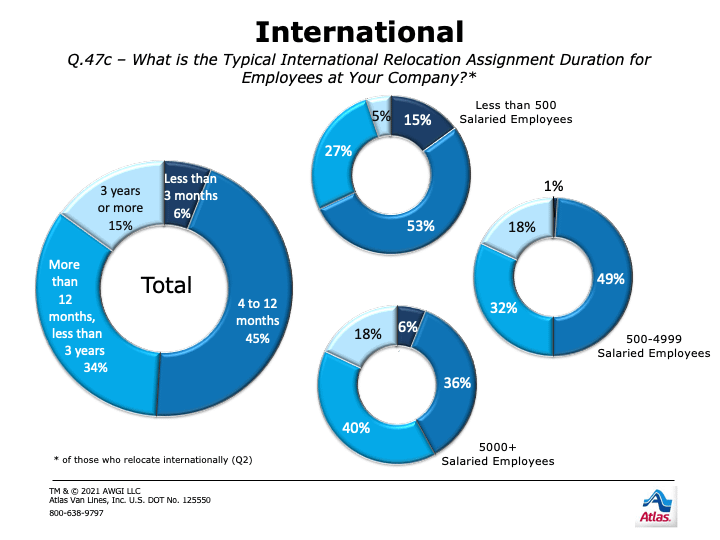

This year, typical assignment lengths of 12 months or less increase to a historic high (51%). This is the first time shorter international assignments overtake other lengths as the most common. A progressive increase of those using shorter assignments occurred from 2015-2020 when it was roughly three times as likely to be the typical assignment length than in 2011-2014. Until 2015, the majority of firms overall reported that international assignments were typically 1-3 years in duration. The percentage of those saying 1-3 years is the typical assignment length falls to the lowest level historically (34%), trending higher in 2020 (52%). It dropped from 59% in 2014 to 44% in 2015 and remained under 50% between 2015-2019, notably below the higher levels of 2011-2014 (54%-61%). Longer engagements of three years or more are far less utilized (15%) and remain near the lowest levels historically.

- Firms across size see far more usage of short international assignments (67% small, 51% mid-size, 42% large) compared to 2020 (42% small, 35% midsize, and 30% large), when usage was more similar regardless of size. However, even with the increases across size, small and midsize firms are more likely to use these shorter assignments, similar to 2017-2019.

- Use of short assignments at small firms reaches the highest level historically (67%), more than twice as likely to be offered than those 1-3 years (27%) and markedly higher than 2015-2020 (40%-53%). At large firms, short assignments as a "typical" assignment length reach a historic high (42%), far more than the previous high (30%: 2020 & 2015), 3-4 times higher than previous historical norms. Usage of short assignments at midsize firms also reaches a historic high (51%) after trending 34%-45% between 2015-2020. Use of shorter assignment types by midsize and small firms is now roughly triple or more that of 7-8 years ago.

- Assignment lengths of 1-3 years fall 16%+ compared to 2020 for both large (40% vs. 56%) and midsize (32% vs. 54%) firms, dipping only slightly less among small firms (27% vs. 38%).

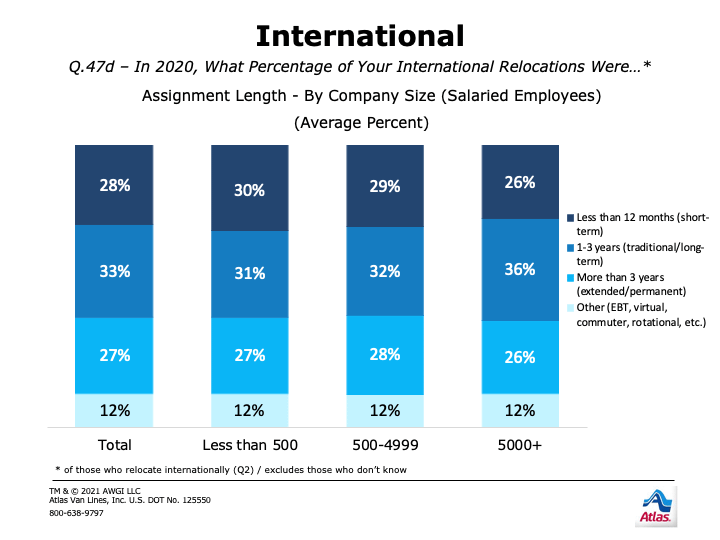

- Overall, firms estimated that around one out of three assignments were 1-3 years, more than one out of four were short-term, and roughly one out of four were longer in 2020. Around two out of eight belonged to another type of assignment (commuter, rotational, etc.).

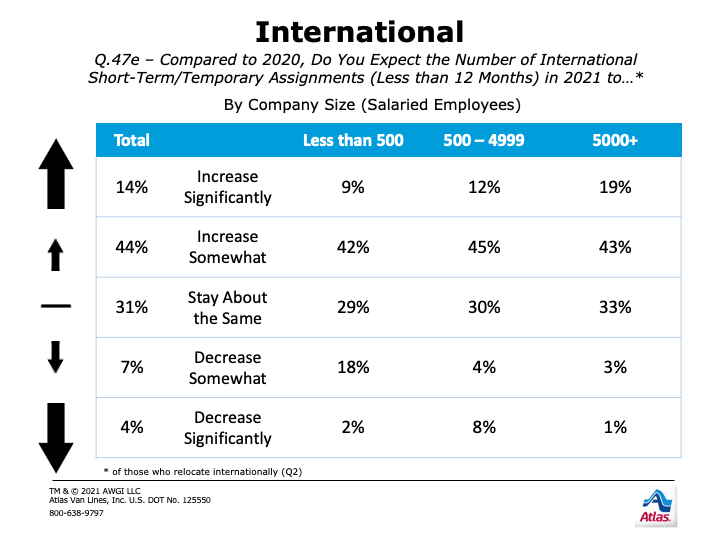

- More than half of firms expect their use of short-term/temporary assignments to increase during 2021 across company size. Almost two out of three large firms expect increases. However, while few midsize or large firms anticipate decreasing usage of shorter assignments, one-fifth of small firms anticipate doing less. Only around a third expect stability in frequency for this type of international assignment.

DESTINATION

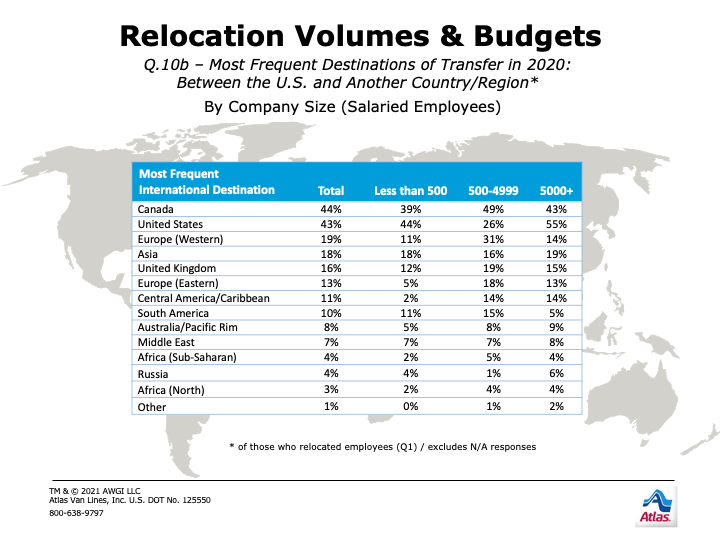

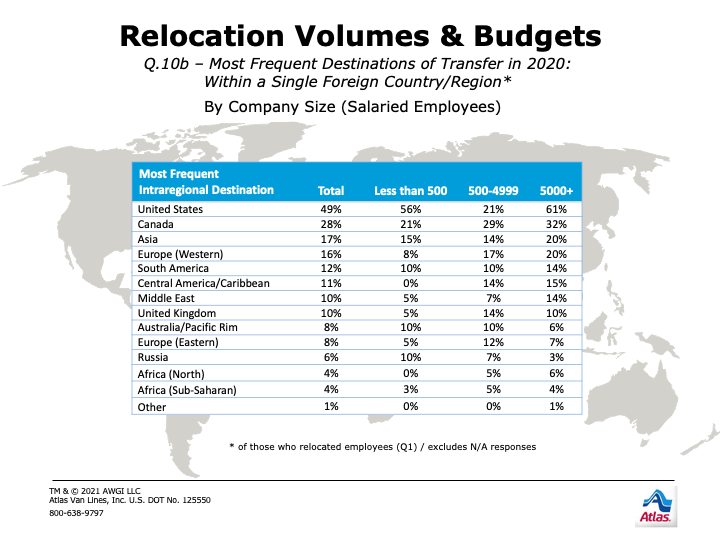

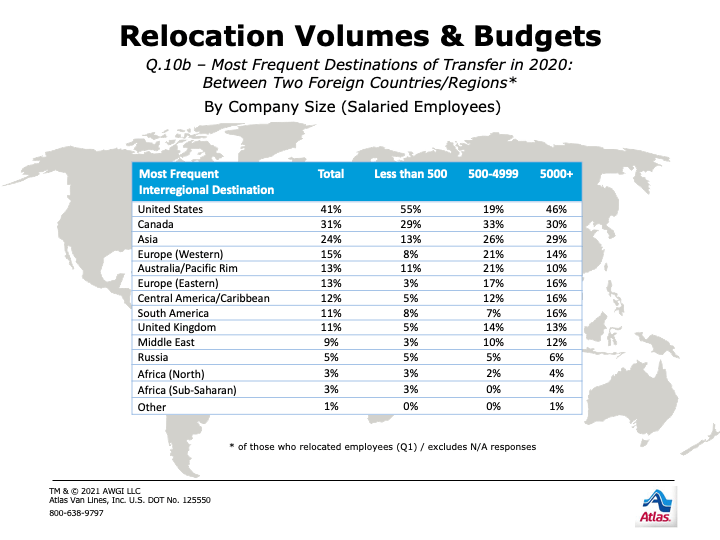

Despite stricter immigration, pandemic border closures, and a challenging political climate, the United States was a top international destination again in 2020. The most-frequented destinations for relocations between the U.S. and other countries/regions were Canada (44%), United States (43%), Europe (U.K. & mainland Europe) (36%), and Asia/Australia/Pacific Rim locales (24%). The United States was first in intraregional transfers of expatriates. Both immigration to the U.S. and movement of foreign nationals within the U.S. remain markedly higher for a seventh year (31%+ vs. 18% in 2013). Canada ranked second for intraregional transfers (28%), followed closely by Europe (U.K & mainland) (24%) and Asia/Australia/Pacific Rim destinations (22%). The United States was the top destination for interregional transfers (41%), followed by the Asia/Australia/Pacific Rim region (33%), Europe (U.K. & mainland) (32%), and Canada (31%).

- Previously, among all types of international relocations, European destinations combined (U.K., Eastern & Western Europe) eclipsed most other regions, with roughly half of firms saying this geographic block was the most frequent destination—whether outbound from the U.S. or inbound from another country. This declined markedly in 2020: only around a third cited European destinations for those leaving the U.S. (36%) and going to another country (32%).

- Comparatively, it appears that if international relocations were undertaken, companies said North American (U.S. or Canada) international origins and destinations were most common (61% & 71%). The North America region also saw a higher percentage reporting intraregional activity last year among those doing international relocations (66% vs. 53%+ 2018-2019). Since international relocations saw the greatest declines in volume last year, it is likely these percentages reflect that more international relocations were performed much closer to corporate "home" than expansively overseas.

- Around a fourth of firms overall cite Asia/Australia/Pacific Rim destinations for outbound moves from the U.S. or within another foreign country/region, and 33% report moves within the Asia/Australia/Pacific Rim area happened interregionally.

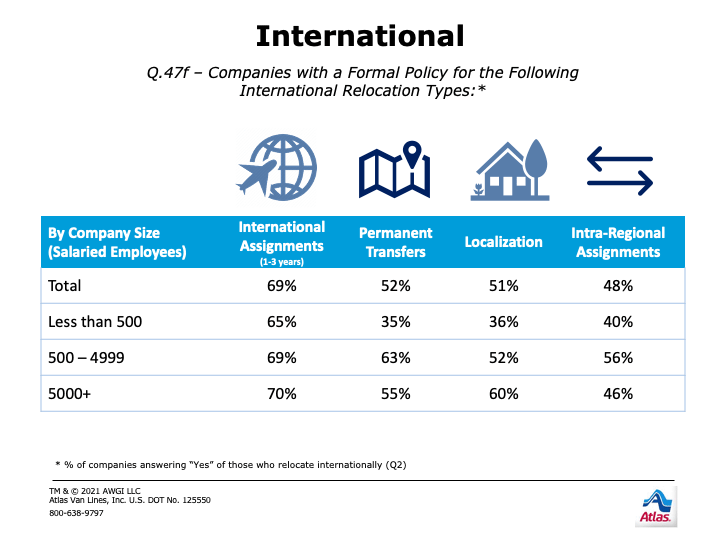

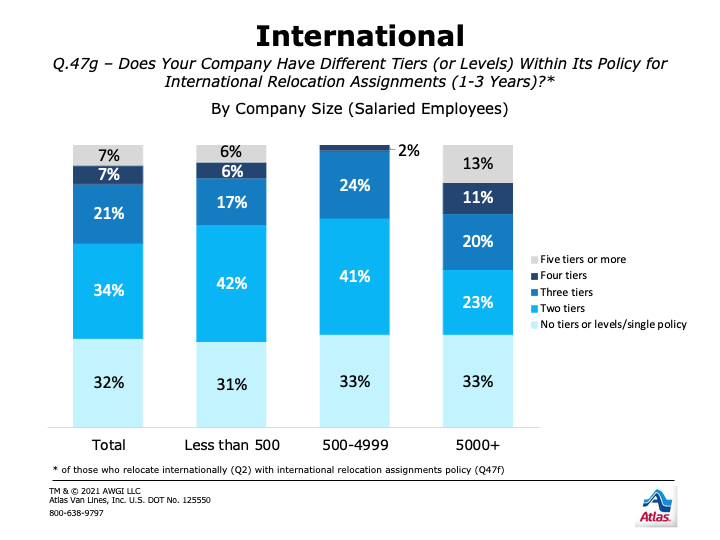

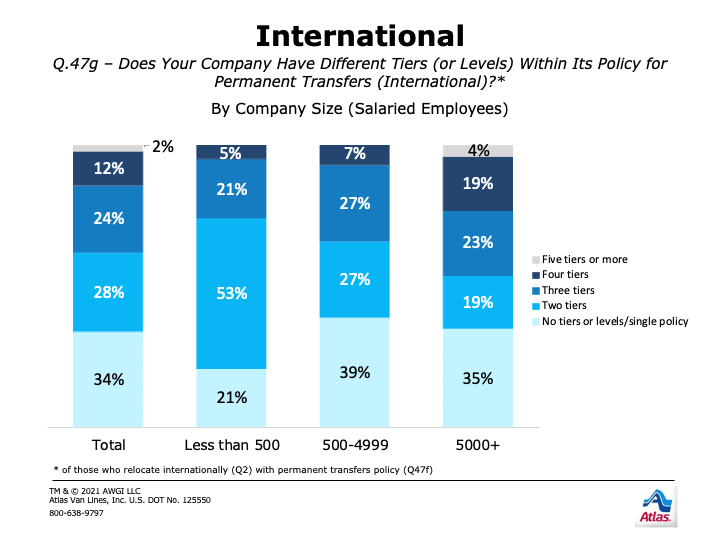

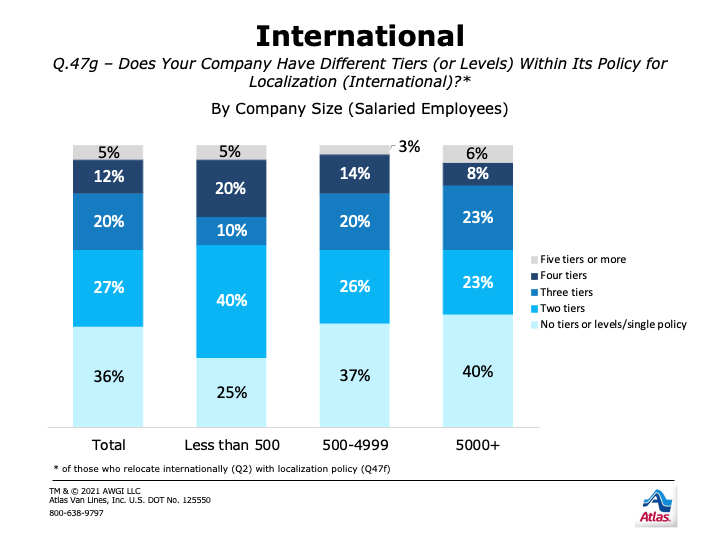

POLICY

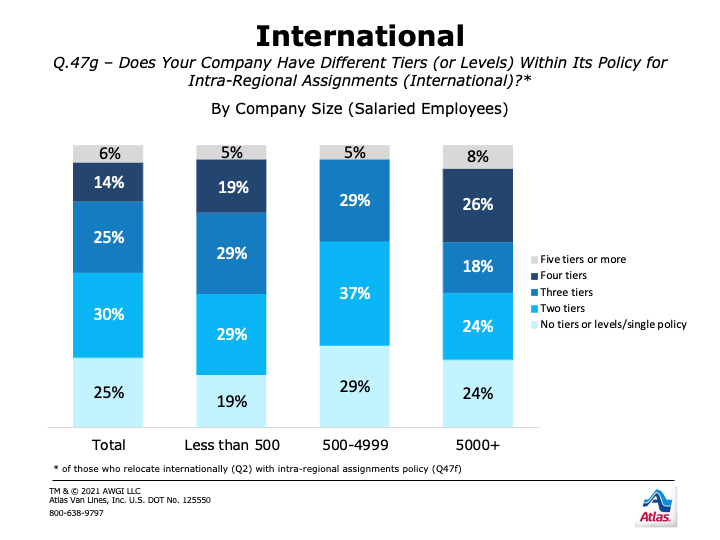

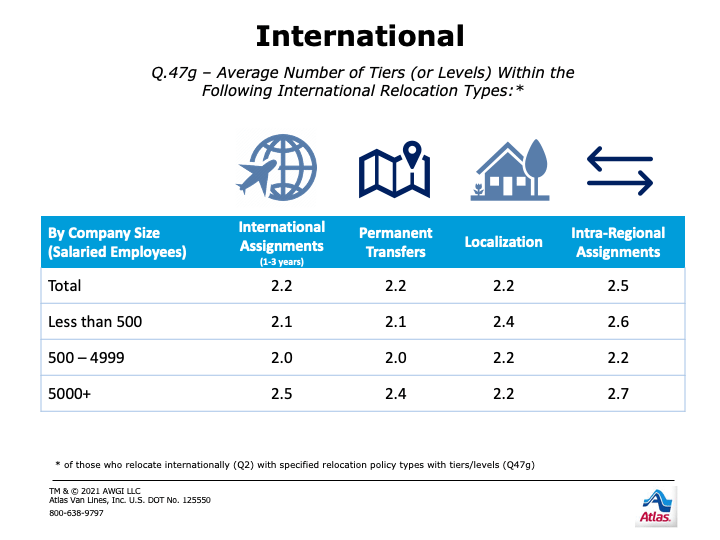

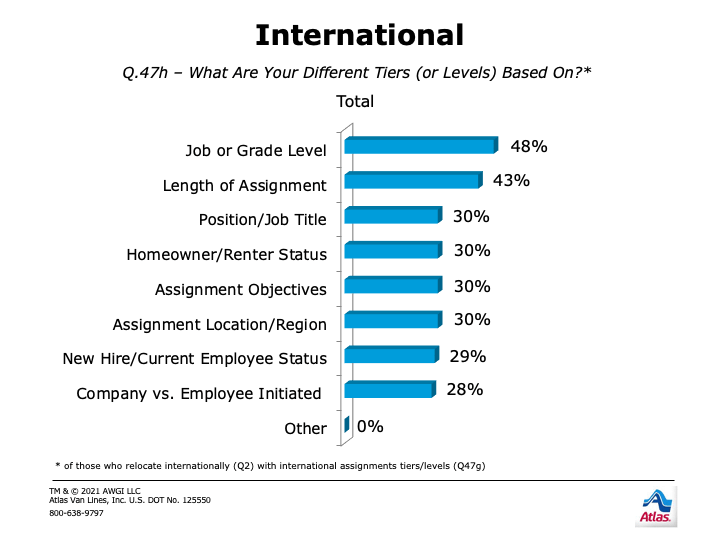

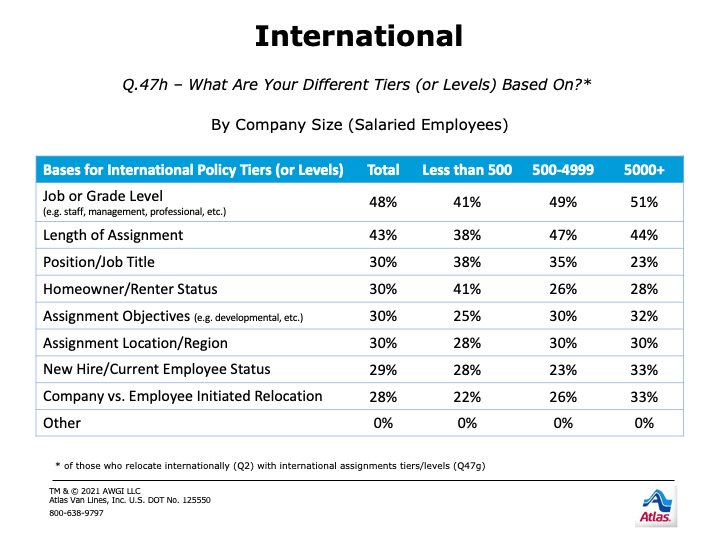

Most firms, regardless of size, average two or more tiers within each international-policy type (overall, permanent transfer, localization and intraregional). For tiers in the overall policy, the top two criteria are job/grade level (48%) and assignment length (43%). While the weight of job/grade level is similar to domestic policy (45%), assignment length is far more impactful internationally (43% vs. 30%), and position/job title is less important (30% vs. 42%).

- Homeowner/renter status ties with job/grade level for first place at small firms (41%), with assignment length and position/job title a close second (38%).

- Job/grade level (49%) and assignment length (47%) are nearly equal in weight at mid-size firms and very closely weighted at large firms (51% & 44%).

- Position/job title carries far more weight internationally at small or midsize firms than large companies (38% & 35% vs. 23%).

- Homeowner/renter status plays a larger role at small firms internationally (41%) compared to midsize and large firms (26% & 28%).

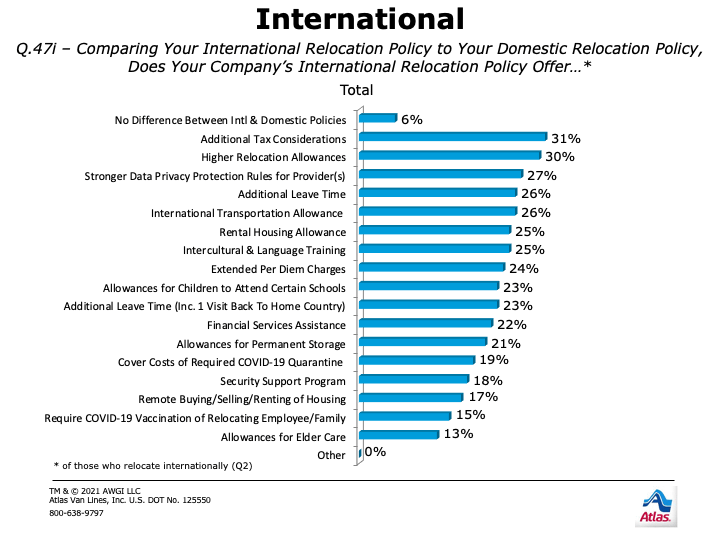

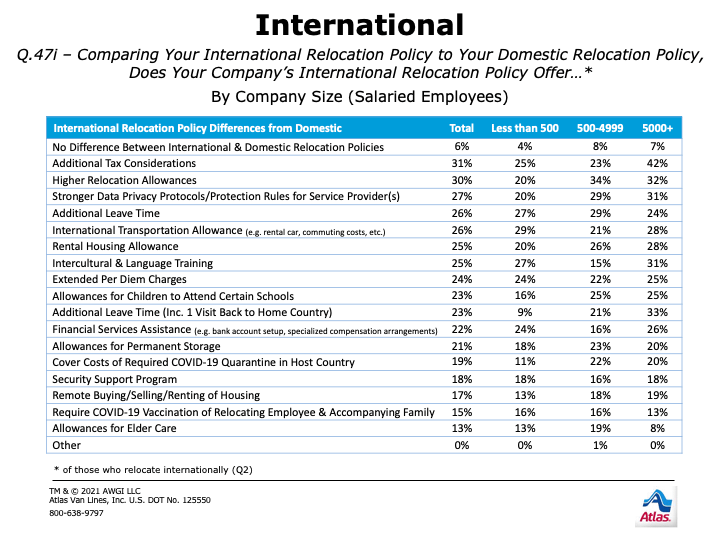

- For the seventh year in a row, the vast majority of firms (and the highest percentages historically) report differences between domestic and international policies. Generally, the percentages of firms offering specific policy allowances fall below last year’s levels, with many individual offerings remaining at or near historical lows. We note these exceptions:

- Extended per-diem charges increase slightly and are in the midrange (24% vs. 11%-28%) of the last 18 years.

- More firms are requiring stronger data privacy protocols/protection rules for service providers (27%) than last year (16%) or in 2019 (20%).

- Additional leave time trends similar to the last six years (26% vs. 28%-35%) and above historical lows (16%-18%).

- Although small, firms providing allowances for elder care is roughly twice that of 2018 (13% vs. 6%) and has progressively increased over the past four years.

For the first time, we asked about the impact of COVID-19 on international policy and learned the following:

- Roughly one out of five firms say they cover costs of required COVID-19 quarantine in the host country; midsize and large firms are more likely to do so than small (22% & 20% vs. 11%).

- One out of six firms specifically allow the remote buying/selling/renting of housing.

- 15% say they are considering requiring COVID-19 vaccination of relocating employees and accompanying family.