POLICY ADMININSTRATION

Relocation Policy

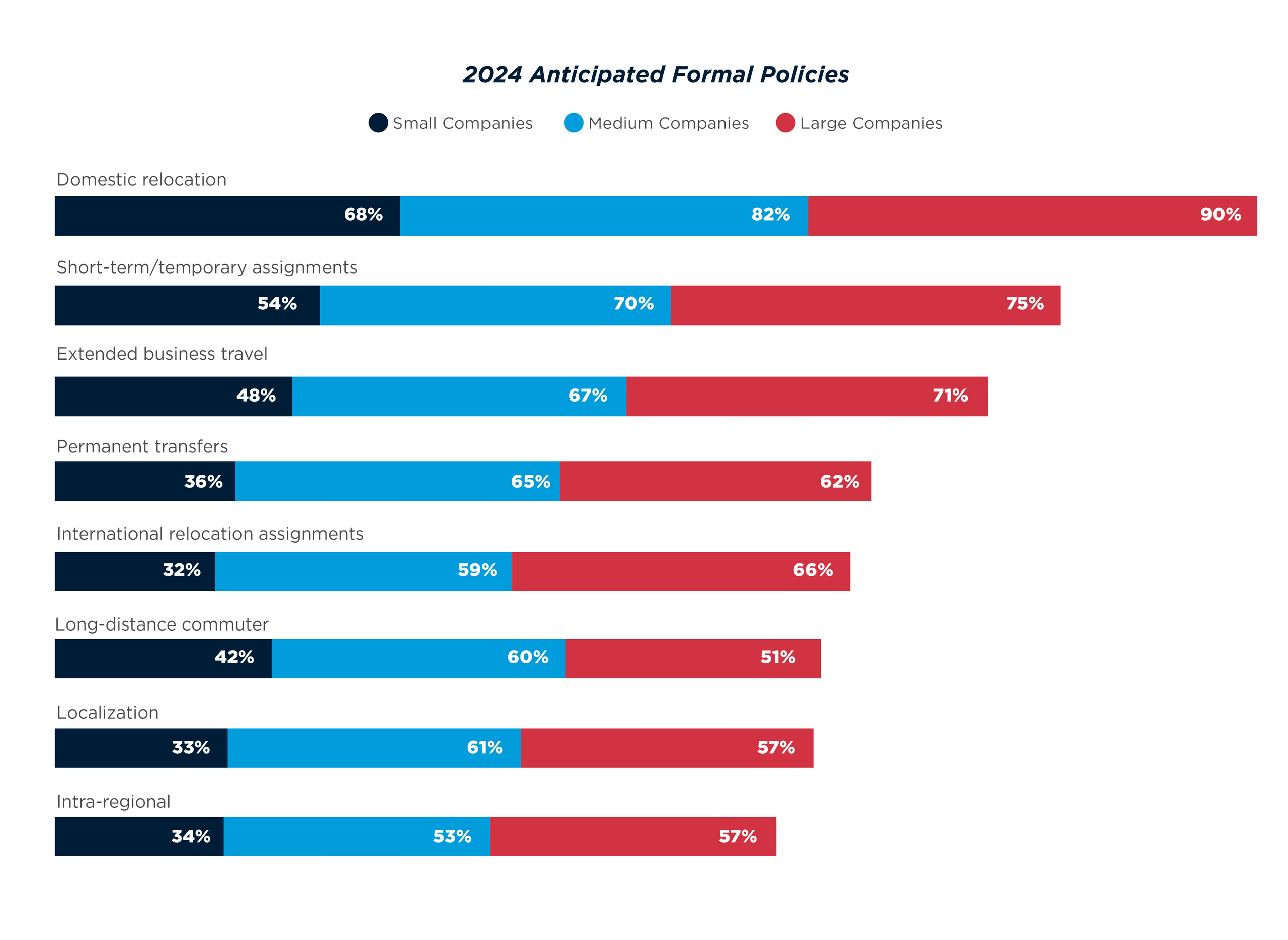

Most companies have formal policies for domestic relocations (81%), international relocation assignments (56%), short-term/temporary assignments (68%), permanent international transfers (60%), localization (56%), long-distance commuters (56%), and extended business travel (65%). Half of company respondents have formal policies regarding intra-regional relocation (international) (51%).

- The largest formal policy increases compared to last year come from medium companies with a 10-point increase for short-term/temporary assignments (70%), an 11-point increase for permanent international transfers (65%), and a 14-point increase for extended business travel (67%).

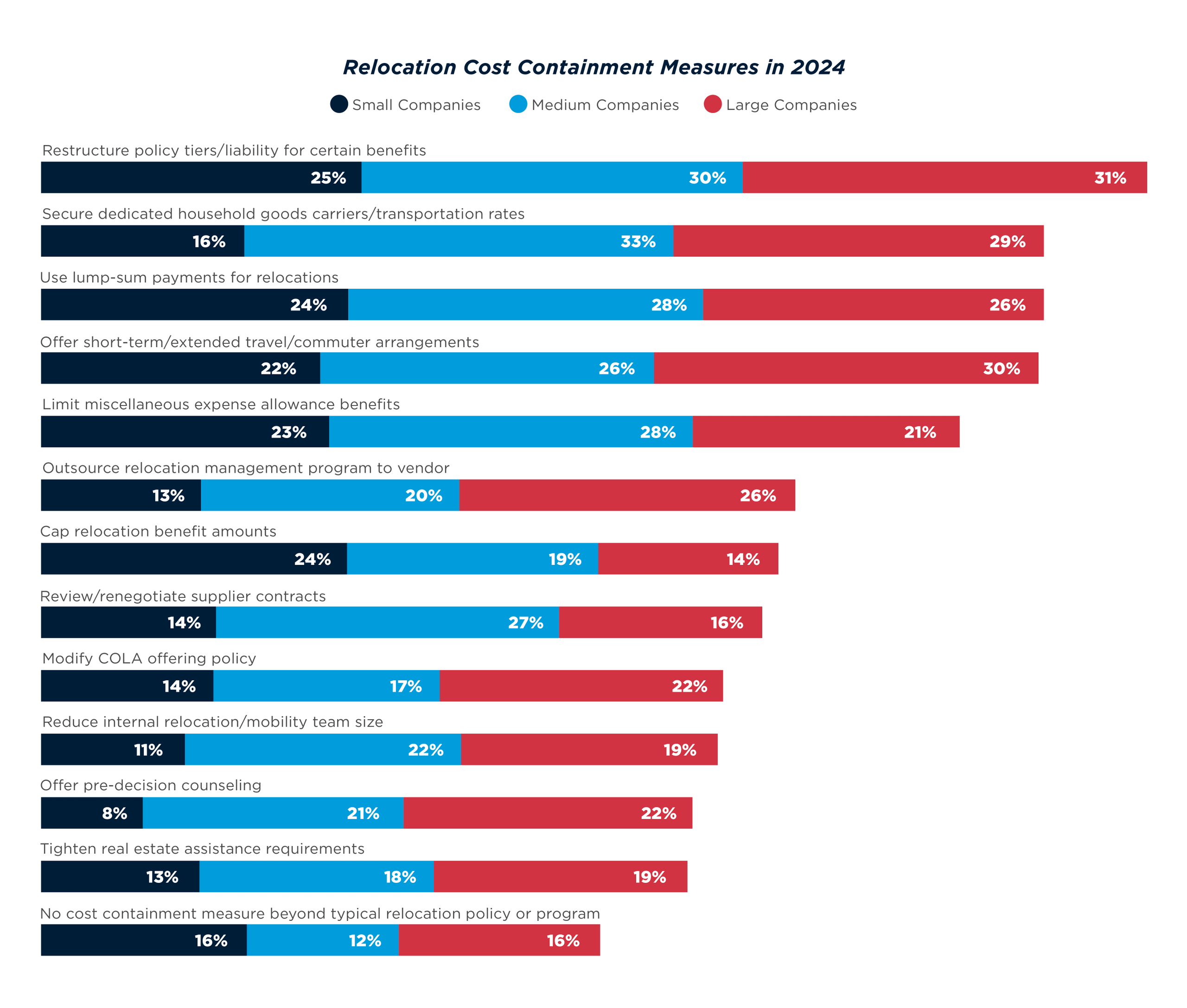

In terms of relocation cost containment plans for 2024, the most common measures include secure dedicated household goods (HHG) carriers/transportation rates to streamline lump-sum relocations (30%), restructure policy tiers/eligibility for certain benefits (29%), and use of lump-sum payments for relocations (27%).

Alternative Assignments

Companies reported that alternative assignments are typically used in place of long-term assignments (41%) or traditional short-term assignment arrangements (37%). The most common factors to determine if an alternative assignment will be used are job function (52%), followed by business need (49%), and employee request (43%).

Roughly 1 in 3 companies stated that they utilize domestic alternative assignments either on a limited basis (33%) or frequently (30%). 42% are using alternative assignments internationally on a limited basis, and 28% are using them frequently. Close to half (44%) of large and medium companies are using alternative assignments internationally on a limited basis.

Lump-Sum Benefits

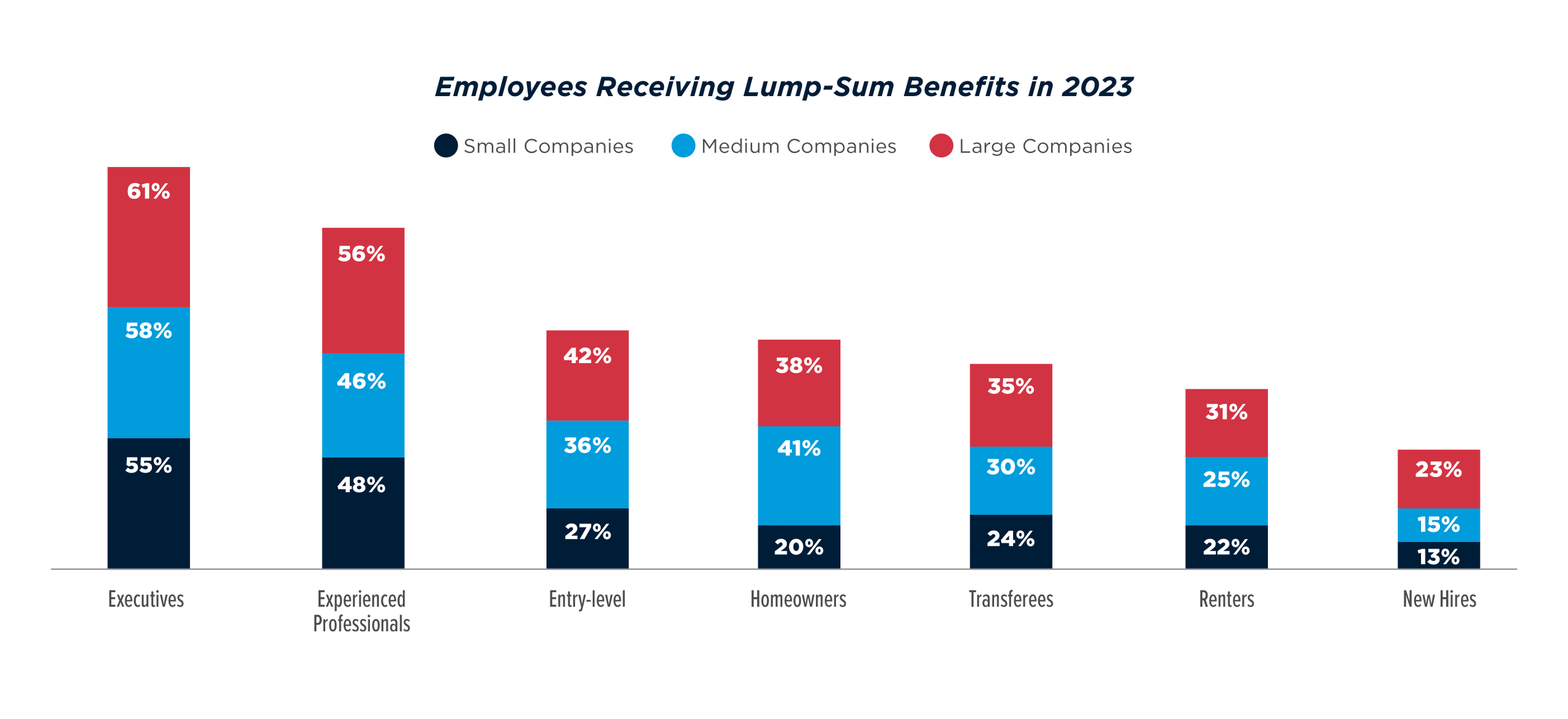

2023 saw shifts in how companies are handling lump-sum benefits. In terms of the types of employees who receive lump-sum payments, executives (58%) followed by experienced professionals (48%) are most common. The largest annual changes are around new hires, which decreased in receiving lump-sum benefits by 6 points, and executives, which increased by 11 points.

In addition, domestic relocations continue to be the relocation type for which lump-sum payments (63%) are most commonly provided, followed by short-term/temporary assignments (42%), and international long-term assignments (40%). These types mostly stayed the same compared to last year with a slight increase (up 8 points) in domestic relocations receiving this benefit.

- Typical lump-sum amounts overall are between $10,000 and $12,499 (20%).

- 75% of companies agree they are interested in having a sole HHG provider if corporate pricing were extended to lump-sum payouts.

- 66% of companies agree they would consider excluding HHG from lump sums.

Relocation Services

The most common services for a quarter of all companies outsourced to relocation services, human resources outsourcing (HRO), or brokerage firms in 2023 were:

- 25% - Management of service provider(s) GDPR/data privacy law compliance

- 25% - Arrangement of family’s transportation and accommodations

- 25% - Expense management/tracking/reimbursement services

The management of GDPR/data privacy law compliance increased from 19% outsourced in 2022 to 25% in 2023 and increased for both medium and large companies.

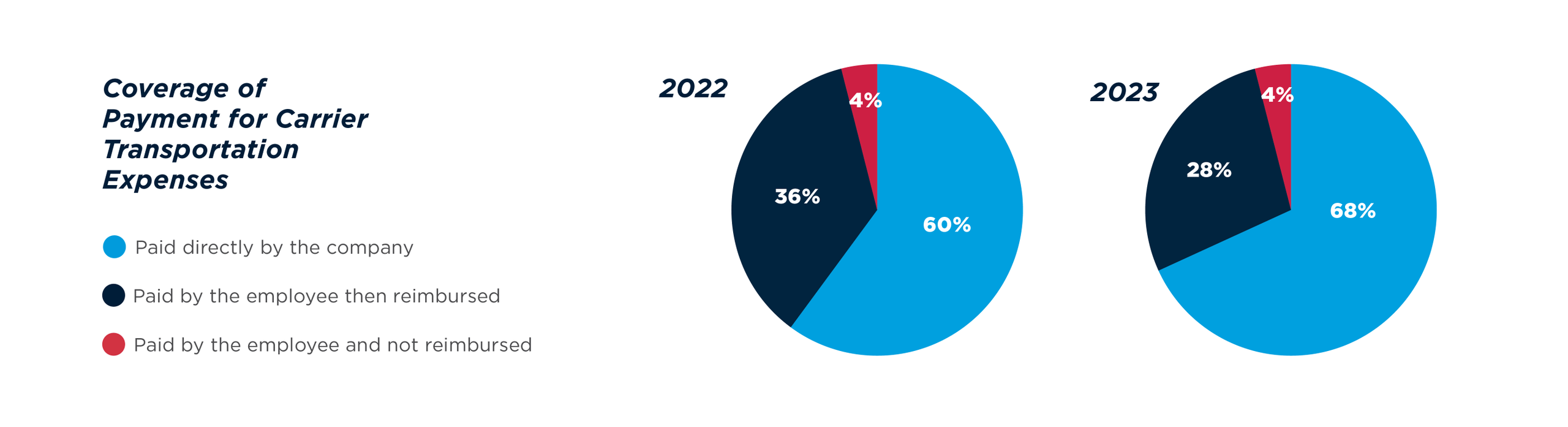

Similar to last year, most companies pay directly for carrier transportation expenses (68%). This did have a 10-point increase compared to last year for medium companies (71%), and in turn, expenses paid for by the employee and then reimbursed had a 10-point decrease compared to last year for medium companies (26%). Large and small companies had slight shifts in both but not to the extent of medium companies.

Assistance Policies

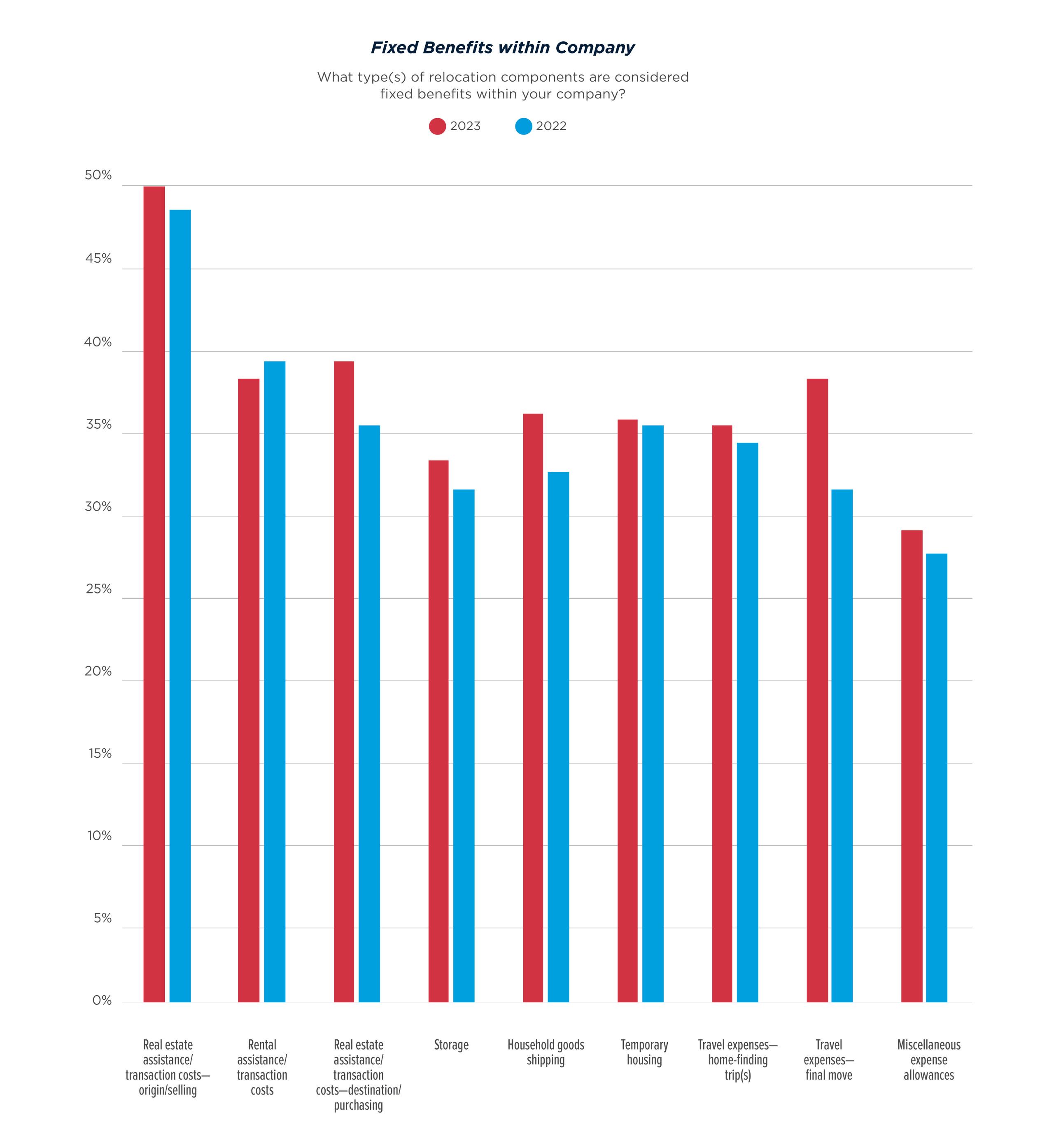

There were very few notable changes in the type of fixed benefits offered from 2022 to 2023, indicating that companies have found an effective balance of offerings to continue to relocate employees. Fixed benefit policies, especially when broken down by company size, indicate a focus on housing/real estate.

- 1 in 2 companies offered real estate assistance/transaction costs at the employees’ origin/assistance while selling in 2023, a 2-point increase from 48% in 2022.

- 39% of companies offered real estate assistance/transaction costs at the employees’ destination/assistance while purchasing in 2023, a 4-point increase from 35% in 2022.

- 38% offered travel expenses for the final move in 2023, a 7-point increase from 31% in 2023.

- 38% offered rental assistance/transaction costs in 2023, a 1-point decrease from 39% in 2022.

- 35% of companies offered temporary housing in 2023, no change from 2022.

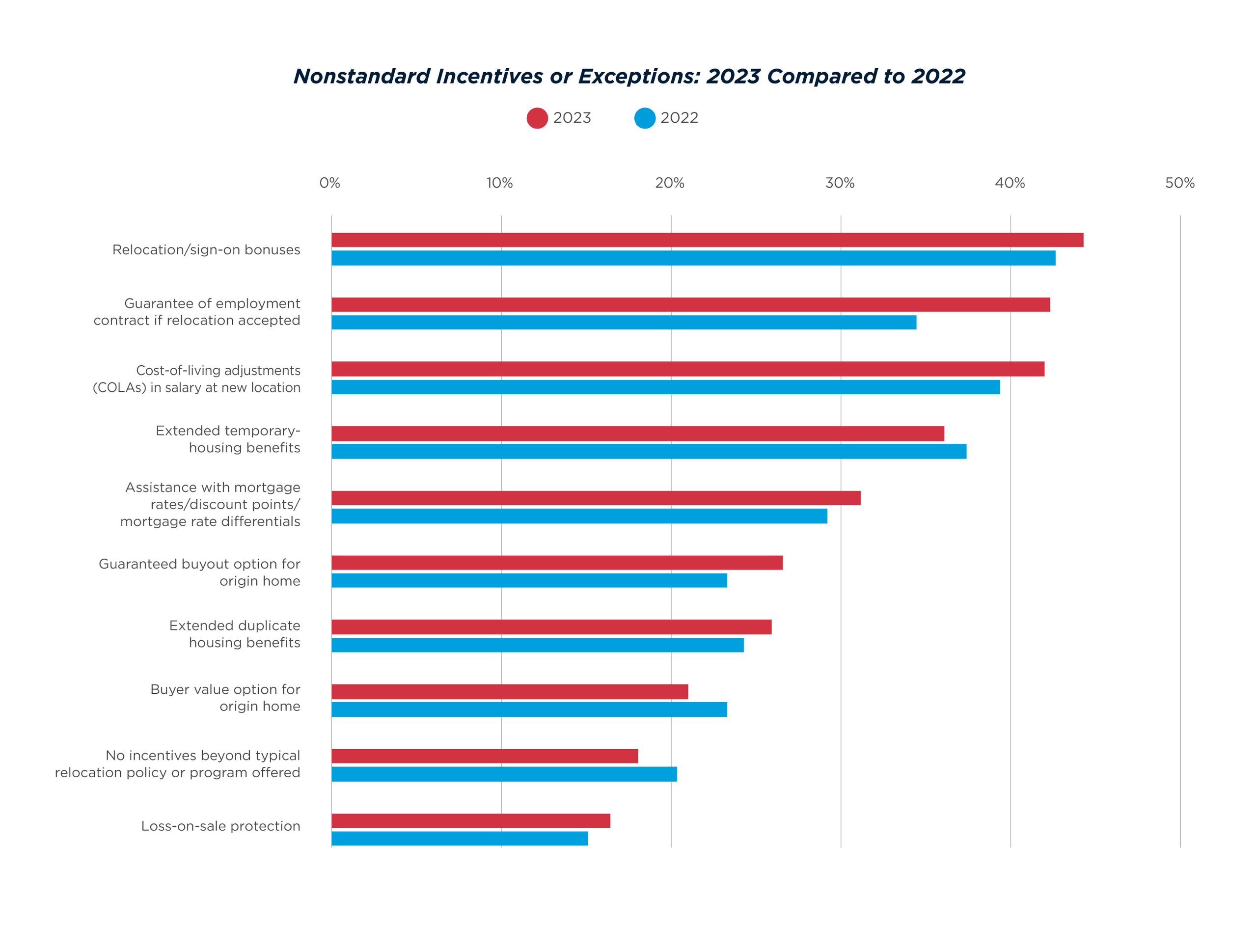

36% of all companies reported that nonstandard incentives or exceptions to typical relocation benefits encouraged relocations “almost always,” while 49% said they encouraged relocations “frequently.” Only 9% of companies reported that these nonstandard incentives did not encourage relocation (“seldom/never”).

Almost all companies increased their nonstandard incentives from 2022 to 2023. The number of companies reporting they did not offer any nonstandard incentives or exceptions decreased from 20% in 2022 to 18% in 2023. The top three most offered nonstandard benefits or exceptions were:

- 44% of companies offered relocation/sign-on bonuses in 2023, a 2-point increase from 42% in 2022.

- 42% of companies offered guaranteed employment contracts for a specified length of time, if relocated in 2023, an 8-point increase from 34% in 2022.

- 42% of companies offered cost-of-living adjustments in 2023, a 3-point increase from 39% in 2022.

These changes point not only to companies’ growth out of the economic stagnation of 2022 but also an understanding of the needs of employees navigating the workforce in a new climate after the pandemic.